- Unemployment, not house prices, is the most important determinant of bank asset quality; a key factor for bank profitability and creditworthiness.

- For now, housing mortgage arrears are very low, and the banking system appears structurally well prepared for a typical household loan-loss cycle.

- Benign outcomes on bank loan-losses could be challenged if the consensus view that we are facing an almost exclusively household loss cycle does not hold or if unemployment was to rise significantly.

This winter Wellington recorded 754mm of rain, swamping the prior high recorded over the past 95 years we’ve kept data. Meanwhile, the seasons may also be changing for households who face a deluge from a 32-year high in inflation and the sharpest 12-month rise in the official cash rate since its introduction in 1999. With these pressures it is worthwhile checking in on how banks will fare with a likely squeeze on household finances.

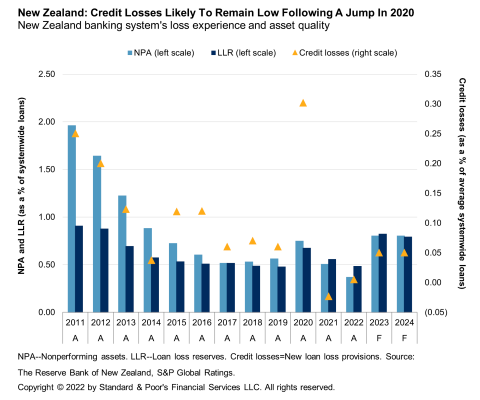

The investment analyst community has struck a generally cautious tone on the outlook for bank loan-losses, as have the global rating agencies. Despite the cautionary tone, bank bad debt provision forecasts don’t conjure up even a mildly concerning scenario which would challenge bank balance sheets.

Typically, actual loan losses secured against Australian and New Zealand home loans are small when compared to the loan losses that have historically occurred on commercial lending. The forecast stress may be modest because bank watchers are focusing principally on households. It might be fine not to fret over housing mortgage losses yet, however, what if we are looking at a business cycle which challenges more than just households? It may be prudent to test the assumption that businesses won’t suffer because of a weakened household.

Falling house prices might seem an obvious concern for banks. But people don’t stop paying their mortgage because their house is worth 10-20% less. Instead, it’s your job that pays the mortgage, not the value of your house. It’s also your job that pays the rent that services investors’ mortgages. Employment is the most important variable for household incomes and most forecasters anticipate only a mild rise in unemployment in the year ahead.

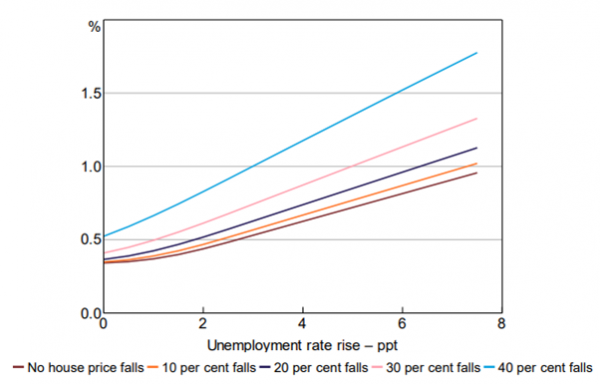

The Reserve Bank of Australia (RBA) recently published their view stress testing banks. As part of that process the RBA mapped how recessions principally impact on loan losses: through a split of loss of income, lower asset values and lower profits. The overwhelmingly largest factor influencing bank loan-losses is the trend in unemployment. If people are not employed, they cannot service their loans. Falling houses prices only become meaningful when declines accelerate to over 30%.

Cumulative Loss Rate by unemployment

rate rise and house price falls

Note: Loan loss rate is cumulated over 12 quarters. Source RBA Research Discussion Paper Macrofinancial Stress Testing on Australian Banks 2022

It is possible the unemployment cycle becomes more evident as house prices and household income continue to fall as this may impact the outlook for construction. The construction sector provides approximately 10% of jobs and a lot of cyclical household income could fall out of the construction sector. However, in New Zealand most commentators point to the current large swell of building consents as likely to sustain building activity through 2023.

Rising interest rates could however make 2023 feel very different for both households and banks. The average outstanding mortgage rate to July has already risen 1.00% from a low of 2.83%. However, the mortgage forward curve suggests that we are only 30% of the way through mortgage rate rises and one-year mortgage rates could be 5.75% a year from now.

Mortgage arrears data remain very low for now. Even when we look to data on the lending made to higher risk borrowers, for example loans to investors with higher LVRs, we are still seeing historically very low arrears positions. Much of this lending is done on floating rate terms so it is not a case of waiting for loans to be refinanced. Perhaps this reflects the fact that employment trends are still strong. The RBA’s study could be right; falling house prices do not in themselves generate larger arrears and bad debts, it is people losing their jobs, and that cycle hasn’t started yet.

We don’t read too much into the current health of housing loans as unemployment remains very low and households generally built savings buffers over Covid. Nor can we draw too much comfort from serviceability tests. While mortgage rates are still more than 1% below the lows the average serviceability test was conducted at during 2020, these serviceability tests haven’t factored in changes to the cost of living.

Drawing this together to make a precise forecast of bank lending losses is difficult in a New Zealand context. This because we have only experienced occasional, episodic and non-linear loan losses from which to model. As a result, many analysts simply normalise loan loss cycles to recent averages. As a lender to the banking sector, it’s reasonable to conclude the sector is better capitalised and more prudently regulated than any time in recent history. But it is also wise to note that small changes in loan losses can make an outsized impact on bank profitability. A final cautionary note is that the bank analyst community is considering a household loss cycle and placing less weight on broader implications of higher unemployment, or business cycle should it occur.

Disclaimer: This article is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Harbour Asset Management Limited is the issuer of the Harbour Investment Funds. Our Product Disclosure Statements for our Funds is available on our website. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.