Key Points

- Many economies, including New Zealand, are re-opening and recovering faster than expected

- High growth rates are normal after such a large contraction in activity and the recovery, so far, is partial

- Ongoing policy stimulus is expected, given the residual uncertainty

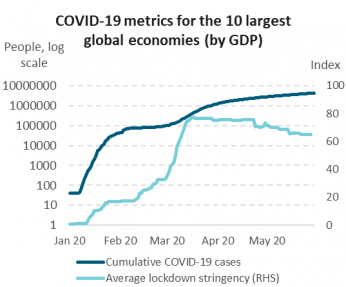

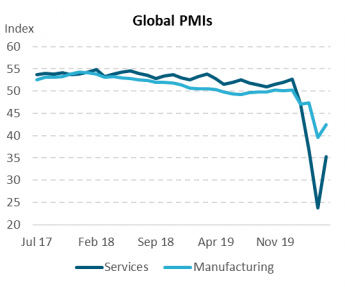

As COVID-19 infection rates slow, economies are re-opening and activity is rebounding earlier than many forecasters had expected. Government restrictions on people’s movement have eased in most of the world’s largest economies over the past month, and global business sentiment surveys have bounced off multi-decade lows, suggesting that global growth likely bottomed in April (see figures below). The US labour market unexpectedly added 2.5 million jobs last month (following 22 million job losses in the two months prior), reducing the unemployment rate to 13.3% from 14.7% previously. The New York Fed’s weekly US economic index derives a common signal from several high frequency indicators and supports the bounce, suggesting US economic activity was 10% lower y/y in late-May, versus 11.5% lower y/y in late-April.

Note: 10 largest global economies by GDP are US, China, Japan, Germany, India, UK, France, Italy, Brazil and Canada. Sum and average are equally weighted.

Source: Bloomberg and Oxford COVID-19 Government Response Tracker, Blavatnik School of Government - Hale, Thomas, Sam Webster, Anna Petherick, Toby Phillips, and Beatriz Kira (2020).

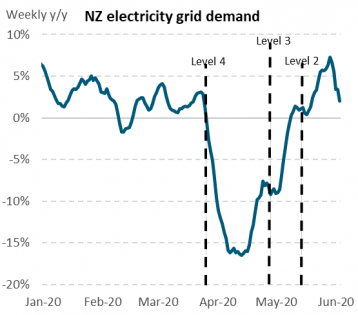

The New Zealand experience has also been encouraging, with domestic restrictions lifted earlier than expected and recent timely economic indicators suggesting the recovery is well entrenched. The Reserve Bank of New Zealand (RBNZ), for example, had expected Alert Level 2 to be in place for 10 months in its baseline economic forecasts.

We can see this recovery from a variety of indicators:

- Electricity demand is higher than this time last year and consumer spending (based on card transactions) has returned to pre-COVID levels, possibly reflecting some post-lockdown catch-up (see figure below).

- The number of job ads on Trade Me, an indicator of firms’ appetite to hire, fell by almost 80% during Alert Level 4 but has steadily increased since then to be around 20% below mid-March levels.

- Business confidence has recovered from all-time lows, with a net 29% of firms in June expecting their own activity to deteriorate over the next six months, down from more than 55% in April.

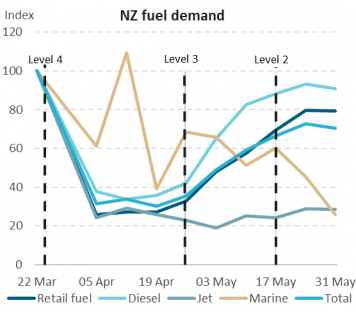

- After falling by more than 60% in Alert Level 4, diesel demand was just 10% below normal at the end of May, in line with heavy vehicle traffic counts and estimated potential activity during level 2 (see figure below).

- Retail fuel demand has also recovered somewhat, with the latest data showing it 30% below normal, versus 70% below during Alert Level 4, possibly reflecting the large number of people still working from home.

Source: Electricity Authority, Z Energy.

Recent data, however, points to the partial nature of New Zealand’s economic recovery.

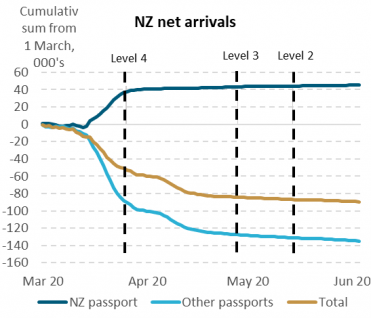

- On a net basis, almost 90,000 people have left New Zealand since March 1st and borders remain closed

- Jet and marine fuel demand was about 70% below normal at the end of May

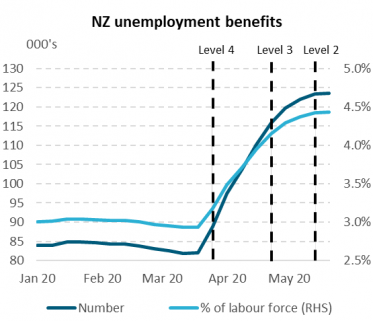

- 40,000 more people are now claiming unemployment benefits than in early March

Like other countries, the services sector is the epicentre of economic weakness, particularly those businesses that primarily service international consumers. The decline in business revenue is likely contributing to reducing confidence, investment and demand for labour. The associated reduction in household income and consumer confidence may not be easily regained and could weigh on consumption.

Source: NZ Customs Service, Ministry of Social Development

Residual health and economic uncertainty mean policy stimulus remains expected. Governments are taking a conservative approach to re-opening economies, given the risk of a second wave of COVID-19 infections. In New Zealand, near-term economic uncertainty centres on the expiry of the Government’s wage subsidy scheme, currently scheduled for 1 September (and may be extended again), and the prospect of borders re-opening. Combined with the large amount of economic damage already experienced, policy makers are expected to continue providing stimulus under a ‘path of least regrets’ approach. For our latest thoughts on NZ’s COVID-19 policy response, please see Large Fiscal Spending Promises, 15 May 2020 and Will RBNZ QE help bridge the gap and how does it work?, 6 May 2020.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.