- NZ interest rates pushed higher this week after the RBNZ revealed it now expects to take the OCR to 5.5% given its greater concern about high inflation and a tight labour market.

- While this action may bring inflation back towards its 1-3% target band more quickly, it may also push the economy into a deep recession next year.

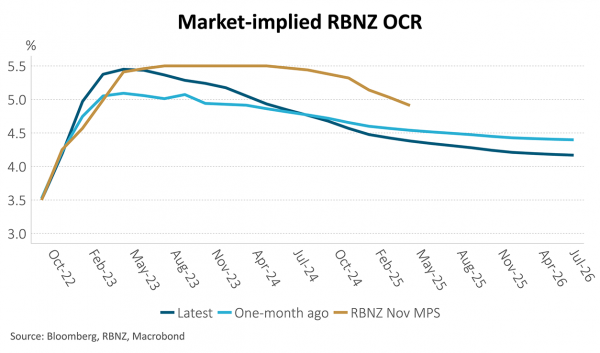

- As the economic damage from higher interest rates becomes more evident, we expect the RBNZ to become more forward looking - placing less emphasis on historic wage and inflation outcomes. We see a high likelihood that the OCR won’t reach 5.5% and may need to be reduced earlier than the end of 2024 that the Bank currently assumes.

The Reserve Bank of New Zealand (RBNZ) increased the Official Cash Rate (OCR) by 75bp to 4.25%, having also considered an increase of 100bp, at its November Monetary Policy Statement (MPS). Most importantly, it forecast the OCR to reach a peak of 5.5% next year as high inflation persists for longer than previously assumed. This was above market pricing of 5.2% and 140bp above the August MPS peak OCR forecast of 4.1%. In response to this announcement short-term interest rates increased 20-30bp but the NZD appreciated only modestly, reflecting the negative economic implications of tighter policy.

Key judgments that may help explain the Bank’s large upward revisions to forecasts for inflation and the OCR are as follows:

- The recent pickup in core inflation and inflation expectations will cause high inflation to persist and imply a higher short-term neutral interest rate. The RBNZ’s preferred measure of core inflation, the sectoral factor model, increased from 5.2% to 5.4% y/y in the latest inflation report and most recently 2-year ahead inflation expectations increased from 3.1% to 3.6%. The RBNZ noted that higher levels of inflation expectations imply a higher short-term neutral interest rate – the interest rate that neither adds nor detracts from economic activity or inflation. As it wants to dampen activity, current interest rates must be above the neutral rate.

While these inflation developments were not surprising to us in the context of headline inflation above 7% y/y, the RBNZ seems to have become more concerned about inflation expectations becoming unanchored. It favours more tightening now, at the risk of a deep recession, to prevent inflation expectations rising (which could require an even longer period of economic pain to resolve). Indeed, the RBNZ is now forecasting a recession in 2023, albeit an optimistically mild one that reduces GDP by just 1%. For reference, the NZ economy contracted 2.6% during the Global Financial Crisis.

- Wage growth represents a greater upside risk to inflation. While recent wage growth has been generally in line with the RBNZ’s August MPS forecasts, the Minutes of the meeting suggest a greater concern that public sector wages, that have lagged the increase in private sector wages, will catchup.

We acknowledge this risk but believe monetary policy is already working to supress demand and therefore, the ability for private sector firms to pass on higher wage demands to prices. This downdraft to spending will only intensify over the coming year. - The RBNZ is seeing insufficient household hurt, describing them as “resilient”. In making this conclusion, the RBNZ cites strength in household balance sheets and the level of consumption relative to pre-Covid levels rather than the large drop in household wealth this year and large drop in Q2 consumption (the latest official data).

The approach is not entirely backward looking, however, as the RBNZ acknowledged that the “impact of rising interest rates on households’ spending and saving decisions is an important channel for monetary policy”. The RBNZ expects this channel to be working hard over the next 1-2 years, with house prices to fall a further 10%, residential investment to drop 14% from Q2 2023 and consumption to decline. We think the risk is that this channel works much better than the Bank is currently assuming, reducing the need to take the OCR as high as 5.5% and possibly leading to earlier cuts than the late 2024 period the RBNZ currently assume. The evidence on weakness in household spending, wealth and specifically forward-looking influences on housing suggests very significant downside risks into 2023.

We think this more aggressive approach from the RBNZ is likely to bring inflation back towards its 1-3% target band more quickly, but it may also push the economy into a deep recession next year. As the economic damage from higher interest rates becomes more evident, we expect the RBNZ to become more forward looking. We see a high likelihood that the OCR won’t reach 5.5% and instead anticipate the adoption of a potential reduction in the pace of rate increases as we move into 2023 with a likelihood of a pause beyond April 2023.

Given the shift in focus from the RBNZ, inflation and labour market outcomes are likely to be more important domestic drivers of the NZ fixed income market than usual. Global developments will also matter, including whether inflation continues to decline, the degree to which labour markets loosen and the way in which central banks respond to these developments.

Important Notice and Disclaimer

This article is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.