Harbour’s investment team has decades of experience in managing Australasian shares and New Zealand bonds. Whilst over time, investors generally experience favourable market conditions allowing us to generate positive returns, it tends to be the downturns that people remember most.

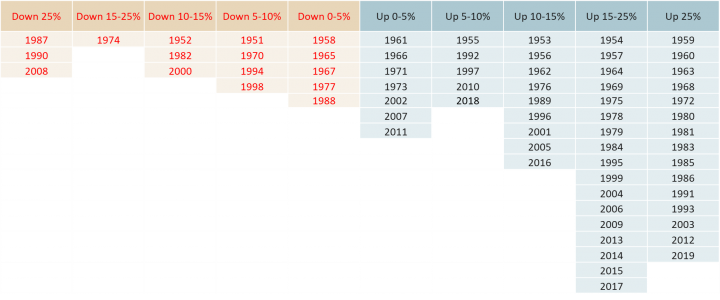

The table below illustrates this, as New Zealand share market returns were positive for around three quarters of the years shown:

Annual returns for the NZ market since 1951

Source: Harbour, NZX

Since 1950 the New Zealand share market has delivered investors an average return of 12.1% p.a. and we have had only three occasions when share markets fell by 25% or more in a year. However, the market has risen by 25% or more 15 times. It is time in the market, not timing the market that delivers the best returns.

So, what is a professional investor like Harbour doing whilst markets are so volatile? “Sticking to our knitting” as the saying goes. Investing is our day job and, as it is our passion too, we are thinking about navigating through these rough times 24/7.

Fear and greed may drive markets to unreasonable extremes in pricing. Professional investors like Harbour use time-honoured investment disciplines to overcome those behavioural biases that all humans have. Applying our ongoing research and analysing data, we identify opportunities that may arise due to mispricing to continue to actively manage investment portfolios. In a downturn like we are currently seeing, Harbour is taking advantage of lower prices to buy more of the stocks we like while they are on sale. As an active manager, we know the companies that we invest in very well, and if we liked them at higher prices, then we like them even more now.

For example, when the world was catastrophising on the 23rd of March 2020, we were selectively buying shares in companies we rate highly. This was at the end of a week when many KiwiSaver investors switched from growth-oriented portfolios to conservative or cash portfolios. It saddened us to see people losing focus on their long-term objectives.

Investing is a long-term endeavour. Current volatility is a sobering example of why this is so. Given time, markets should recover along with those quality companies that benefit from the environment we find ourselves in on the other side. That is not to say that all companies whose share prices are currently low are worth buying. Companies that might benefit are in the healthcare, consumer staples and materials industries. Whereas companies involved in consumer discretionary products and services may face more challenging times for longer.

How will we know when we reach the other side? Firstly, the data on COVID-19 needs to stabilise and the extraordinary policy responses by governments and central banks around the world need to really kick in. In reality though, the turning point will only be known in hindsight when we have the data to prove it. Nobody can reliably predict when this will happen, not even the professionals.

In the meantime, try not to look at your investment balance too often. If the investment was designed to meet your objectives when you originally invested, then it’s probably still the right one for you.

Give it time.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.