Key Points

- Novel Coronavirus (2019-nCoV) is a more contagious coronavirus than Severe Acute Respiratory Syndrome (SARS) and Middle East Respiratory Syndrome (MERS), but fortunately, has a lower fatality rate so far.

- While we can look to SARS for the potential economic impact, China’s position in the global economy is far larger now than it was in 2002/03.

- Equity markets have typically rallied once the number of new cases peaks. We are not yet at that stage and expect volatility until that happens.

- We have added to some stocks with structural tailwinds that have been sold off as a result of the event. But otherwise, we are taking a vigilant stance continuing to emphasise longer term positive structural influences.

- This is continually evolving, World Health Organisation (WHO) situation reports are being produced daily and are available online. In addition, cases are being tracked in real time here.

Background

There are several types of coronaviruses which have impacted humans since the mid-1960s. The more recent versions of coronaviruses are Severe Acute Respiratory Syndrome (SARS) and Middle East Respiratory Syndrome (MERS).

Each coronavirus tends to have different characteristics, and this latest coronavirus, Novel Coronavirus or 2019-nCoV, is no different. The data so far shows that 2019-nCoV is far more contagious than SARS or MERS, but fortunately is less deadly with a mortality rate of 2%, much lower than SARS (9.6%) and MERS (~35%). So far, the fatalities have been most prevalent among older males with existing respiratory issues such as emphysema.

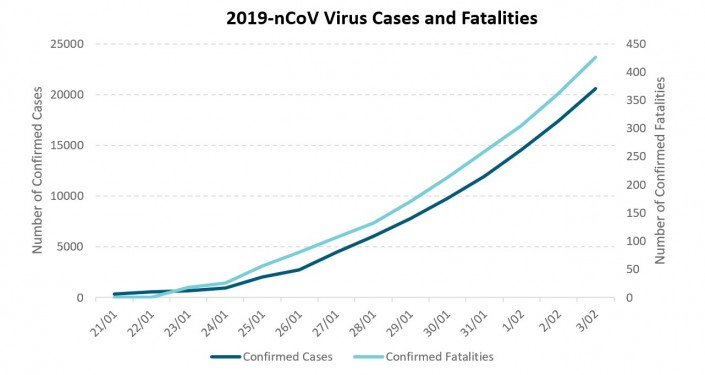

According to the latest WHO report (February 3, 2020), there are 20,571 confirmed cases of 2019-nCoV, which has claimed the lives of 426 people (425 in China, 1 in the Philippines) so far. Somewhat critically, up until this point the number of new reported cases has continued to accelerate. As well as the severe human toll, there will of course be an economic impact resulting from reduced consumer confidence and activity, disruptions to supply chains and complications to logistics.

Source: Bloomberg, WHO, Johns Hopkins

Economic Impact

It is far too early to accurately estimate the economic impact of 2019-nCov. While past epidemics, such as the SARS outbreak in 2002/03, can offer some insight into the possible economic impact, direct comparisons will prove to be inexact. China’s share of global output today is over double what it was at the onset of SARS, and China’s share of global trade is around 2.5 times what it was in 2002. Consumption and services, areas likely to be most negatively impacted, are now a much larger share of China’s economy.

Another key factor around the economic impact is the swift steps taken by China to contain the virus. While widely criticised for the slow reaction to contain SARS, China’s response to contain 2019-nCov has been faster and more extensive this time. An outcome of this is that the reaction, which will save many human lives, will likely result in a larger short term hit to activity than SARS did. Chinese authorities, cognisant of this, have already announced a raft of stimulus measures to cushion the economic blow from 2019-nCoV. These include injecting liquidity, cutting central bank repurchase rates, lowering lending rates and fees for companies and regions most affected by the outbreak and encouraging banks to not call in loans to affected firms. Despite this, it is likely that we will see GDP growth expectations cut for the first half of 2020 and, globally, monetary policy will remain accommodative.

Market Impact

We have already seen sharp market movements as this situation has unfolded. China, commodity and tourism exposed stocks have been hit the hardest. Some healthcare stocks have benefitted from expected higher healthcare spending. Chinese A-shares, which resumed trading after an extended Chinese New Year break, closed down -7.9% on the first day of trading; albeit they continued to recover somewhat as new stimulus policy measures were announced.

Bond markets have benefitted from a flight to quality. Since confirmation of Novel Coronavirus on January 7th, the 10-year US Treasury yield has fallen 35 basis points (bp) to 1.52%, close to the September 2019 low of 1.42%. Expectations of rate cuts from the US Federal Reserve have doubled, from one rate cut over the next 12 months, to two. In New Zealand, our 10-year government bond yield has fallen 23bp to 1.23% over this time, and expectations of our Reserve Bank easing over the next 12 months has increased from 14bp to 22bp of cuts.

Global commodity prices have fallen more than 10% in response to the Coronavirus outbreak. The Commodity Research Bureau’s (CRB) Index is currently around its lowest levels since early 2016. Oil prices have dropped more than 20% since early January, with Dubai crude oil (the most relevant benchmark for New Zealand) currently USD55 per barrel. Milk futures provide a real-time gauge of the impact on New Zealand commodity prices, and they have fallen 3% since the Coronavirus outbreak.

In terms of the market impact, as opposed to economic impact, we believe history is a potential guide. In previous epidemics, markets only recovered after the number of new cases peaked. We recently heard from a coronavirus expert, who believes it may not be until mid- February, at the earliest, that this occurs.

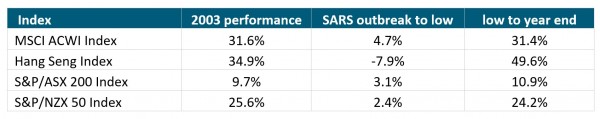

Below we look at the impact SARS had on markets in 2003.

Source: Bloomberg, MSCI. Outbreak date February 6, 2003. “Low” is the low of the Hang Seng index.

How we are positioned

We do not profess to know more about 2019-nCov than anyone else. We have tapped our global research partners and contacts to learn more about the virus from experts, and have attempted to understand what the past can, and cannot, teach us.

Having a long-term investment focus, which aims to identify companies that will benefit from structural change, means that, at the margin, we have added to some stocks with structural tailwinds which have been sold off as a result of the event. But otherwise, we are taking a vigilant and patient stance.

Within fixed income, portfolios were structured for rising interest rates as forward-looking economic indicators and government spending plans are supportive for future growth. Following the disease outbreak, we have reduced this position, purchasing assets that will perform well if the Reserve Bank lowers the Official Cash Rate (OCR).

It would also be remiss to not mention that, prior to the outbreak of this unfortunate virus, we were seeing increasing evidence of a U-shaped rebound in global activity. Chinese activity indicators were improving, which was helping the European manufacturing sector to show signs of bottoming. The latest read of US Manufacturing PMI, released February 3rd, also showed a rebound in activity. So, while undoubtedly growth will be revised down for H1 2020, the silver lining may be that it did not hit during the period of economic weakness we saw in mid-2019.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.