- Many New Zealand listed companies will be reporting against new climate disclosure regulation for the first time this year.

- The U.S. SEC has recently approved new mandatory climate reporting rules, following in the footsteps of New Zealand and other countries.

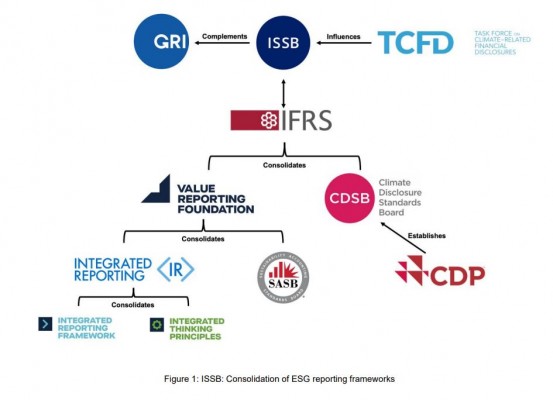

- Globally, sustainability reporting standards have been developed under the newly formed International Sustainability Standards Board, involving the consolidation of existing frameworks.

- Voluntary sustainability disclosure from New Zealand corporates to date has been mixed, with examples of both bare minimum reporting and those providing detailed information aligned with credible frameworks.

Sustainability considerations, particularly climate change, have risen in prominence over recent years with greater attention paid by governments, companies, and investors alike. Improving transparency through reporting has been one specific area of focus among policy makers and standard setters with numerous frameworks developed and regulations introduced to encourage more quality disclosure in this area. Key examples of this are the new climate related disclosure regulation here in New Zealand and in the U.S. while there has also been a shift towards better comparability and standardisation in global reporting through new international sustainability reporting standards.

New Zealand Climate-related Disclosures

For most NZX-listed companies this year, climate reporting is front of mind with new mandatory standards kicking in. These standards have been developed by the External Reporting Board (XRB) and follow from legislation that was introduced by the previous Government in late 2021. The standards largely mirror an existing climate framework known as the Taskforce on Climate-related Financial Disclosure (TCFD) recommendations that are centered on four key pillars: governance, strategy, risk management, metrics and targets. Despite this framework being around since 2017, voluntary disclosure has tended to neglect the more difficult, technical aspects such as scenario analysis (especially linking this to financial impacts). At the conference we attended, we saw how many New Zealand companies have been taking a collaborative, industry-based approach to selecting appropriate climate scenarios to help promote comparability. This will be useful for investors when comparing disclosures between companies in the same sector by having a common baseline.

New U.S. climate reporting rules

Many countries have followed in New Zealand's footsteps in introducing mandatory climate reporting rules, the most recent being the United States. Just in the past week, the Securities and Exchange Commission (SEC) adopted rules for climate disclosures by public companies, following an extensive consultation process that began in early 2022. The rules will apply in a staggered timeline based on the size of the issuer starting from 2026. Although some of the requirements are less stringent than originally proposed (e.g. only needing to report direct emissions if considered material) it is still a significant step forward in a country where views on environmental, social and governance considerations have been particularly divided as of late.

Global sustainability standards

While New Zealand was one of the first countries to mandate climate reporting and develop associated standards, a significant development on the global stage occurred at the 2021 UN Climate Change Conference (COP 26) with the establishment of the International Sustainability Standards Board (ISSB). The ISSB is an independent standard-setting body that sits within the IFRS Foundation and has now developed two global reporting standards, one for climate specifically and the other for general sustainability disclosure. An important feature of these new standards is that, rather than adding to the plethora of existing voluntary frameworks, leading to more confusion, they have instead been developed to consolidate and unify them into one central framework and standard-setting body. The standards also follow the familiar TCFD structure outlined above and aim to integrate with IFRS accounting standards by sharing much of the same language and principles (e.g. materiality is defined the same way).

The state of voluntary reporting

The state of play in the New Zealand market in terms of voluntary sustainability disclosure has been variable. Some laggards have only provided the bare minimum corporate governance disclosures with scant commentary on environmental and social aspects. On the other hand, leaders in the space have adopted existing, credible frameworks such as the Global Reporting Initiative (GRI) and TCFD to provide structured and detailed reporting on sustainability initiatives. In our view, best practice disclosure typically involves a combination of quantitative metrics and real-life case studies of companies creating meaningful change, with a few examples including Meridian Energy, KMD Brands and Chorus. We also acknowledge how the whole market in general has improved significantly in sustainability disclosure over the past few years, reflecting the greater importance companies are placing on environmental and social impacts.

Investment implications

The emergence of climate and sustainability reporting standards, both locally and globally, is helping to facilitate increased transparency for investors that are integrating these considerations into their decision-making processes. These frameworks also aid companies by providing a common language to present relevant sustainability information but may be perceived by some as a compliance burden, particularly when governments like New Zealand have moved to mandate these reporting standards. Regardless of how corporates view these regulations, the outcome will undoubtedly be a greater level of sustainability-related information publicly available that can be used to influence investor decisions. At Harbour, we will be closely monitoring how these disclosures play out, integrating key information into our investment process to deliver better outcomes in our portfolios.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.