Key Points

- Budget 2020 revealed larger-than-expected potential spending in response to COVID-19

- However, detail was lacking on many spending priorities

- The accompanying larger bond issuance programme may prove difficult for the market to digest, placing upward pressure on government bond yields

As part of its Budget 2020, the Government announced an additional $15.9bn of fiscal stimulus today; taking the total COVID-19 response so far to around $42bn, or 13.5% of Gross Domestic Product (GDP), one of the largest globally. The creation of a $50bn COVID-19 Response and Recovery Fund (CRRF) allows for an additional c.$20bn of spending and, if used in its entirety, the total fiscal stimulus delivered in response to COVID-19 would be $62.1bn, or 20% of GDP.

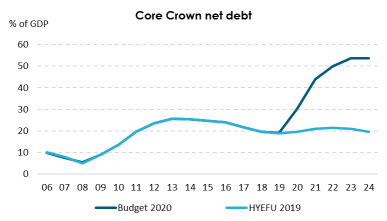

Government debt is projected to increase from 19% of GDP in 2019, to 53.6% by June 2023. While a high number by New Zealand standards, this is low versus other countries. The OECD average, for example, is around 100%. Ratings agency Standard & Poor’s (S&P) indicated its comfort with the Budget, saying New Zealand’s positive rating outlook is supported by S&P’s expectations that the economy should recover faster than the Budget assumes, and fiscal deficits may not be as large or persistent.

The key areas of additional spending are:

- $4bn business support package, of which $3.2bn relates to a targeted wage subsidy scheme 8-week extension (from 10 June to 1 September), for those who have suffered a 50% reduction in turnover over the 30 days prior to application compared to last year.

- $3bn infrastructure investment, with specific projects still to be determined. The Government noted that it will have a focus on regional infrastructure projects identified through the Provincial Growth Fund and on projects that advance other goals of the Government.

- $1.6bn trades and apprentices’ package to provide opportunities for people to receive trades training.

- $1bn environmental jobs package to provide jobs and support habitat protection, pest control and biodiversity on public lands.

The Government also announced it would spend $5bn to build 8,000 public or transitional houses over the next 4 to 5 years, but that this would be funded via the Kainga Ora borrowing programme.

The Government has created a $50bn COVID-19 Response and Recovery Fund (CRRF) to help manage its policy response. This is in addition to the $12.1bn stimulus package announced on 17 March. Prior to the Budget, the CRRF had allocated $13.9bn to additional stimulus, announced after the 17 March package, and after allowing for the $15.9bn of additional spending initiatives announced in the Budget, around $20bn remains. If used in its entirety, the total fiscal stimulus delivered in response to COVID-19 would be $62.1bn, or 20% of GDP.

The Treasury’s economic projections are more negative than the most positive (and most likely) scenario it published on 13 April. Without full use of the CRRF, and assuming $35bn of fiscal support, average annual real GDP falls 4.6% to year ended June 2020, the unemployment rate peaks at 9.8% in Q3 (dropping to around 7% a year later) and CPI inflation drops to 0.4% y/y in Q4. House prices decline 6% in year to end-March 2021.

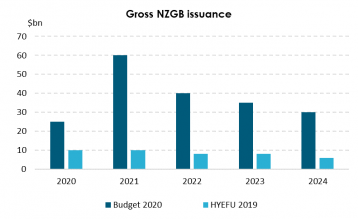

The Debt Management Office (DMO) forecast NZ Government Bond (NZGB) issuance to increase materially to $60bn in 2020/21, $40bn in 2021/22, $35bn in 2022/23 and $30bn in 2023/24 (from $25bn in 2019/20 and around $10bn in normal times). This includes $1-2bn of inflation-linked government bonds in 2020/21 and implies outstanding nominal government bonds of $65bn could increase to around $120bn by end June 2021.

Note: HYEFU is the Half-Year Economic and Fiscal Update. Source: Stats NZ, the Treasury, NZ Debt Management Office.

The large pickup in issuance may place pressure on the Reserve Bank of New Zealand’s (RBNZ) recently expanded $60bn Large Scale Asset Purchase (LSAP), or Quantitative Easing (QE) programme. Having already bought around $10bn of New Zealand Government bonds (NZGB), if the RBNZ continues to purchase bonds at its recent pace ($1.35bn/week), it may not be able to absorb the $48.9bn of net NZGB issuance in 2020/21, leaving the DMO increasingly dependent on demand from other investors, including those offshore. Given the relative expensiveness of NZGBs to Australian and US government bonds, however, the clearing price of our bonds going forward may be at cheaper levels and the increase in NZGB yields following the Budget announcement reflects that.

There is significant uncertainty regarding the implementation of some Budget plans. As a result, analysts and the market in general are looking for further details. One clear take away from the Budget is the reliance on a larger slice of activity ascribed to the Government. Another message is that rebuilding the economy is likely to take a significant amount of time. The proposed infrastructure plans are likely to take some time to result in higher activity levels. While there is a focus on job creation for the environment, job training and more housing investment through Kainga Ora, the potential for this spending to be front-loaded, or for government job creation to significantly offset likely layoffs in the tourism and other services sectors is, in our opinion, limited.

We think that consumers, and households in general, may be hesitant to take a strong message to increase consumption or investment from this Budget.

The key to New Zealand’s long-term prosperity lies in lifting productivity. Many of the Budget’s more specific details focussed on infrastructure, however a significant amount of the potential spending plans are non-specific. Over the long-term, strengthening our education system, learning from COVID-19 and investing broadly in our healthcare sector should be priorities for specific government spending. Funding could also be directed to policies that promote digitisation, business innovation and decarbonisation.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.