- Inflation may have peaked, reducing the risks of severe monetary policy tightening and a deep recession.

- Supply chains are partly normalising and slowing demand in most economies is reducing extreme pressures on prices.

- Tight labour markets, however, are placing upward pressure on wages and the current high inflation rates mean that central banks may retain a tightening bias for some time.

Global economic growth has slowed more rapidly than many had anticipated this year but there may be a clear benefit: lower inflation. After a year of unexpectedly large increases, inflation has started to surprise analysts to the downside in recent months. US inflation peaked at more than 9% in June but dropped to 8.5% in July and may continue its trajectory lower as tighter monetary policy feeds its way through economies. US financial conditions have tightened considerably, and the economy is expected to grow by less than 2% this year, versus almost 6% in 2021 when the economy benefitted from a post-Covid reopening. Even weaker growth outcomes can’t be ruled out, with financial markets suggesting a 70% chance of recession. Russia’s invasion of Ukraine may mean that Europe will likely experience similarly low growth, despite much less restrictive monetary policy settings. Chinese economic growth continues to be hampered by rolling Covid lockdowns, weak consumption, and a troubled property sector. A reluctance from policy makers to deliver meaningful stimulus may mean the country will not meet its 2022 annual growth target of 5.5%.

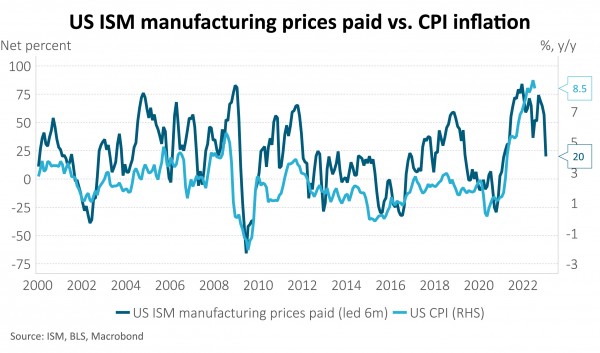

This slowdown in global demand has taken pressure off commodity prices and allowed supply chains to partly normalise. Oil prices, for example, are almost 20% lower than their mid-June peak. Iron ore prices have dropped more than 30% since the highs of early March. Agricultural and fertiliser prices have almost returned to the levels seen before Russia invaded Ukraine. Lower demand has also allowed inventories to be re-built at a faster pace and markedly reduced the proportion of manufacturers that are paying more for inputs. Aggregate measures of global supply chain pressure have more than halved since peaking in December of last year. US business surveys suggest headline inflation may approach 4% year on year over the next six months – less than half the current rate.

Inflation, however, remains too high for comfort in most economies and central banks have more work to do. Global supply chains haven’t yet returned to normal. The war in Ukraine and China’s zero-tolerance Covid policy pose ongoing risks. Core inflation measures are around 4-5% year on year for most of the developed world, broadly in line with current wage growth, and inflation expectations are elevated. Relative to central bank inflation targets of 2%, policy settings clearly need to be restrictive, and the job of taming inflation may not yet be complete. The US Federal Reserve recently accelerated its pace of tightening, increasing the Fed Funds rate by 0.75% to a neutral level of 2.5% in July, and noting it needed to see “convincing evidence” of inflation moderating before slowing its pace of tightening. Financial markets expect an additional 150bp of rate increases over the next 6 months.

In New Zealand, the Reserve Bank of New Zealand (RBNZ) hasn’t yet restored economic balance here and is likely to remain committed to tighter policy in the near term. New Zealand inflation may have peaked in Q2 at 7.3% but the risk of inflation expectations becoming unanchored remains high. 1- and 2-year ahead inflation expectations are above the top of the RBNZ’s 1-3% target band. The labour market is exceptionally tight, and wages have increased notably over the past year. There is little relief in sight as it’s not clear that net migration flows will be helpful in meeting labour demand in the coming quarters. The RBNZ doesn’t forecast inflation to return within the target band until Q2 2024. We expect additional tightening over the rest of the year. But monetary policy works with long lags, and we expect the RBNZ to become more forward-looking in its policy setting, better recognising the peak impact of its tightening is likely to be felt 1-2 years ahead.

A further weakening in demand is likely to be necessary to return inflation to target. While job security is high for much of the world and many developed economy households established a savings buffer during 2020 and 2021, higher interest rates are now posing a challenge to household cashflow. In New Zealand, we estimate that the average household is now no longer able to save without reducing consumption. Many household balance sheets have also been hurt in the first half of this year as property and financial asset prices declined. In New Zealand, we estimate household balance sheets dropped c.10% in value in the first half of this year - consistent with a 2% reduction in consumption via a wealth effect.

Consumers and housing will be challenged. Slowing demand is a key channel through which employment growth slows to a below-trend pace and heat is removed from the economy. House prices have fallen 8% since peaking in November last year and have likely fallen further over the winter. As about half of all outstanding borrowers face significantly higher mortgage rates in the coming months, we expect further pressure on house prices in the likely absence of a significant increase in net migration. Combined with high construction and borrowing costs, the outlook for the residential property sector is challenged.

A deep recession in New Zealand is unlikely. Although households may face several reasons to reduce consumption, we think that the outlook is not a repeat of the global financial crisis. Business surveys that ask firms about their own activity and expectations of it suggest average annual GDP growth will be between 0 and 2% in the coming quarters, versus -2% in the GFC and in 2020. Despite low levels of investment intentions and confidence, the recovery in business lending suggests firms are continuing to invest. Government spending may also continue to support economic growth and given labour shortages employment seems likely to be relatively firm.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.