Key market movements

- The MSCI All Country World Index (ACWI) continued its positive run with a 5.4% return in New Zealand dollar-unhedged (4.7% in NZD-hedged) terms for the month. From a sector perspective performance was broadly positive, with utilities the only negative sector at -0.8%. Leading the way was consumer discretionary at 7.8% and information technology at 6.1%.

- In contrast local market returns for the month were muted, with the S&P/NZX 50 Gross Index (with imputation credits) returning -1.1%, and the S&P/ASX 200 Index returning 0.8% (0.2% in New Zealand dollar terms).

- Bond indices were mildly negative over the month. The Bloomberg NZBond Composite 0+ Yr Index fell -0.2%, whilst the Bloomberg Global Aggregate Bond Index (hedged to NZD) also lost -0.7% over the month. 10-year government bond yields in the US rose slightly, ending the month at 4.3%, whilst in New Zealand the 10-year yield remained relatively flat ending at 4.7%.

Key developments

A weaker-than-expected earning reporting season dragged the New Zealand share market lower over the month of February. The New Zealand share market profit reporting season for the December period got off to a weak start with pre-result season profit downgrades from Air New Zealand, Fletcher Building and Ryman. Reporting season got better with the core of high certainty New Zealand companies generally delivering on expectations. Overall, the New Zealand share market has seen more profit misses against expectations by number than beats and more post-result consensus earnings forecast reductions than increases. Net earnings downgrades generally reflected costs continuing to increase while revenue slowed. But there were signs of a basing in earnings with several companies noting green shoots of a recovery in activity and a peaking in the rate of cost increases.

RBNZ rate hikes remain off the table, at least that was the message we and the market took from the February MPS. The central bank left the OCR at 5.50%, lowered its OCR forecast path by 10bp to peak at 5.6% and implied rate cuts to start in H1 2025, from H2 2025 previously. This was unexpected by most of the bank economist community who had ascribed some chance to a hike, two even calling for a hike, and not anticipating the OCR forecast path would be lowered. The market was also conscious of the hawkish risk, which led to a notable market reaction. Short-term interest rates fell c.20bp and the NZD depreciated c.1% following the decision. The tone was much more balanced than the November MPS and speech from Chief Economist, Paul Conway, in late January. The RBNZ recognised that excess capacity was becoming evident, and this was partly related to tight monetary policy working. Core inflation and most inflation expectation measures have declined, such that inflation risks have been become more balanced. The RBNZ did note, however, that with inflation still above target, tolerance for upside surprises is low. We continue to expect rate cuts to begin in August, at which point it will be abundantly clear that an OCR 300bp above neutral is not necessary.

The US economy remains in good health, suggesting Fed rate cuts aren’t imminent. Real-time estimates of GDP growth are in a 2-3% range and the labour market continues to create jobs. There are also signs that the housing market is responding positively to the c.100bp drop in mortgage rates in Q4. US CPI inflation surprised to the upside in January. Core PCE inflation (the Fed’s preferred measure) also picked up and the Fed is aware of the risk that inflation reaccelerates. Minutes from the US Federal Reserve’s January meeting noted the recent strength in the economy and that the Committee is carefully assessing the need for policy adjustment. The minutes also reiterated the message from the January statement that the Committee ‘does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.’ Markets currently price 80-90bp of cuts this year, vs. 150bp at the beginning of the year and the median Fed ‘dot plot’ forecast of 75bp.

The rest of the world doesn’t look so good. Euro area growth remains non-existent with the manufacturing sector contraction offsetting expansion in the services sector. With core inflation falling, the European Central Bank is likely to start easing before the middle of this year. China continues to struggle. Lunar New Year spending data showed weaker per capita spending and a domestic tourist preference for cheaper destinations. There is speculation that the Third Plenum (China’s 5-yearly meeting to set its economic agenda) will soon be announced, after being expected in October last year. While this may help sentiment, it is unlikely to provide any immediate help to economic growth. Consumer and producer prices are falling, the real estate sector hasn’t yet stabilised, private investment is in decline and consumption is weak. In Australia, recent data have shown a larger-than-expected softening in activity, job growth and inflation. RBA Governor Bullock recently indicated that she thought the tightening cycle was likely finished. The market currently prices 40-50bp of easing this year, taking the cash rate below 4% by year end.

What to watch

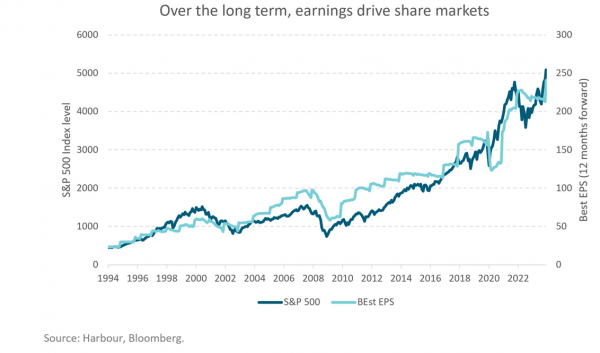

In a month where NVIDIA announced c.400% earnings growth for the past 12 months, it feels like a timely reminder to keep an eye on earnings. Over the long term, one of the most important drivers of market returns is earnings growth, as we see below:

Market outlook and positioning

Share markets may be in a transition period in terms of economic settings and company earnings trends. While the recent earnings reporting season was mixed, we may be on the cusp of a better earnings environment. The prospect of less volatile interest rate conditions provides better valuation support than has been the case over the last 12 months. Transition periods have favoured selective investment and active equity portfolio management, with an increasing dispersion in returns between shares in companies that are better positioned for change from those that are not.

The recent rally in parts of the global share market has driven the proportion of market capitalisation in shares with high valuation multiples to levels similar to those reached during the highs of 2021. But the prevalence of extreme valuations today looks far less widespread than in 2021 after adjusting for market concentration. In contrast with 2021, the weighted average cost of capital (WACC) is much higher today and investors are focused on margins rather than ‘growth at any cost.’ While share markets may see a pull-back from recent highs, we continue to expect markets to make further gains through the year. Official interest rate cuts later this year (by the US Federal Reserve, and possibly from the RBNZ and Reserve Bank of Australia) should support share market valuations, where not associated with a deep recession, while profit momentum should be positive supported by a fledgling positive turn in activity. Falling rates and rising earnings per share can be an explosive combination for share market returns.

For the last several months we have held the view that monetary policy is tight and that this will slow the economy and bring inflation down. We believe we are seeing more tangible evidence that this is happening, and it clearly sat behind the RBNZ's more balanced appraisal of inflation risks going forward. While we have held our core view, market rates have been volatile, with the 2-year swap rate peaking at 5.8% in October, before falling to 4.6% in December, rising to 5.3% in February and in early March it now sits just above 5.0%. Prevailing market yields suggest there is still considerable scope for further sizable falls in time. Market pricing, at the time of writing, anticipates the Official Cash Rate only declining to 3.9% by the end of 2026. That is three more years of tight monetary policy and well above the 2.5% long-run neutral cash rate estimate at the RBNZ. It is worth considering that if inflation does settle near 2% and the economy remains very soft, one could argue for easy policy settings, with an OCR below 2%.

Within equity growth portfolios our strategy remains to position for a range of scenarios and to be selective. The potential to return to a pre-COVID lower growth, lower inflation environment supports our continued favouring of investments with secular tailwinds that are less dependent on strong economic activity. Within the portfolios we are selectively overweight shares in the healthcare, information technology and financial services sectors that offer potential for compound growth. While the healthcare sector may remain dynamic and face further disruption from innovative technology, the reset in investor expectations and valuation multiples provides us with the confidence to sustain a relatively large but share-specific investment in this proven compound growth sector. The information technology (IT) sector’s secular growth potential is underscored by the runway remaining in GenAI, improving IT budgets and expectations for improving margins. We remain wary of cyclicals that are dependent on a recovery in consumer and corporate confidence. We continue to have a bias to quality, well-capitalised businesses that are well-positioned to fund value-adding growth opportunities.

New Zealand fixed income continues to be attractively valued in our opinion. While the RBNZ communicated a balanced economic outlook and more confidence in their stance at the recent February MPS, we believe that market pricing of tight monetary policy over the foreseeable future is not appropriate. Instead, we would expect lower, more neutral OCR settings to eventuate as there is increasing evidence that current settings are exerting a strong, downward force on activity that may bring inflation back into the target range. It is possible that supportive OCR levels may be necessary should economic activity slow excessively. This view leads funds to be overweight interest rates out to 7 years. Longer dated fixed income assets face greater supply pressure and are more subject to overseas pricing so positioning here is more tactical as we face specific events.

As regularly occurs in the first quarter of a calendar year, activity in the primary credit market is heightened. With an abundance of new deals coming to market at the 5- to 6-year tenor, we see value in certain issuers, but others appear to be offered at low premiums, which is curbing our enthusiasm. Shorter-dated credit does offer some value and we are targeting credit instruments in the 3- to 4-year maturities for shorter-dated funds. Overall, with credit investments we are very conscious of arrears increasing as the wider economic slowdown manifests itself and we are guarded on entities that are more cyclically exposed or do not have healthy credit protection in their capital structure.

The Active Growth Fund is defensively positioned being overweight bonds and underweight equities. After the recent rally in global share markets the current risk return proposition may not be as compelling as it was, and we may see a period of consolidation in global equity markets. At a headline level, global equity markets (measured by the MSCI ACWI Index) are trading at their 91st percentile valuation when compared to the past 20 years, which is expensive in absolute terms. However, when we look at the forward-looking risk premium relative to bonds, we see an even more extreme outcome, trading at 97th percentile (i.e. expensive relative to history). These valuation levels have historically preceded below-average returns in the following 12 months, which makes us wary of holding a higher weight to equities.

The Income Fund has an overweight in short-dated New Zealand fixed income securities for the reasons outlined above. Over February, the Fund increased this position as yields rose into the RBNZ meeting, which proved a successful trade. We expect markets to remain volatile and will likely use lifts in interest rates as opportunities to add to exposure as we go forward. Valuations are a notable issue in global equity markets at present, particularly amongst the US tech sector's "Magnificent Seven", which includes Microsoft and Nvidia. Our overall equity exposure is 25%, compared with a neutral weighting of 32%. Within Australasian equities we are seeing considerable dispersion in returns, which is giving the opportunity to improve returns through stock selection, and we are likely to increase exposure in equities within the Australasian market. Finally, we continue with an underweight exposure to the New Zealand dollar. Our terms of trade has been weakening again lately and if we see the OCR cuts that we think are likely, there is scope for the NZ dollar to fall.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.