Key points

- The MSCI All Country World Index returned -5.7% over the month in New Zealand dollar-unhedged terms, and -1.8% over the quarter. Returns for the month were slightly less worse in New Zealand dollar-hedged terms, down -4.7% for December. However, the dollar-hedged returns were up strongly (+7.0%) over the quarter.

- The New Zealand equity market (S&P/NZX 50 Gross with imputation) held up well relative to other developed markets in the month of December, finishing down a modest -0.6% with many of the more defensive NZ companies finding a bid. Over the quarter, the NZ market was up 3.8%.

- Despite a very volatile December, long term US bond yields did not end the quarter too far from where they began. The US 10-year bond yield opened the quarter at 3.83%, hit a post global financial crisis high in October at 4.25%, before closing the quarter at 3.88%. The New Zealand 10-year bond yield opened the quarter at 4.30%, briefly dipped below 4% before finishing the quarter at 4.47%.

Key developments

December delivered a bond yield roller coaster which initially saw bond yields falling before increasing sharply at the end of the period, thanks largely to the US Federal Reserve making it clear that they saw little chance that cuts might occur through 2023. This saw equity markets deliver strong returns early in the month, before giving up gains in reaction to the bond market. Returns for growth stocks were hit by the increase in long term interest rates, with the discounting of their longer term cashflows being more sensitive to changes in long term interest rate expectations.

A lower-than-expected US Personal Consumption Expenditure inflation rate for November released earlier in the month (+0.2% month and +4.7% year on year) combined with University of Michigan’s long-run inflation expectations for December at 2.9% (i.e. still anchored), gave investors more evidence of near-term downward momentum for inflation and some hope that the US Federal Reserve may be nearing the end of its rate increase programme (with the US federal funds rate at 4.25-4.5%). However, central banks are likely to sustain tighter financial conditions until inflation is firmly back to target ranges. The story of 2022 was how fast inflation rose. The story of 2023 may be how fast it falls. Even as inflation declines, inflation indices may remain well above of the comfort zone for major central banks, necessitating further tightening even as recession risks loom.

Towards the end of 2022 Chinese authorities eased Covid restrictions, effectively removing travel restrictions from early January (much earlier than expected). Investment markets considered the announcements as being inflationary, triggering a worldwide increase in long-term bond yields. Inflation risk comes in the form of high Chinese domestic infection rates lowering Chinese productivity in December 2022/January 2023, and the risk that the end of China’s zero-Covid policy could lead to a rise in cases around the world, including the emergence of new variants from within China which may impact negatively on global supply chains. In Japan, the Bank of Japan relaxed the boundaries with which it controls 10-year bond yields, also triggering a rise in yields.

Despite a significant upside surprise to New Zealand Q3 GDP, more recent indicators of economic activity suggest the Reserve Bank of New Zealand (RBNZ) rate hikes are having their desired effect. New Zealand GDP grew 2.0% in Q3, well above the RBNZ's estimate of 0.8%, driven by a large pickup in tourism. The detail, however, showed monetary policy at work. Household consumption fell 0.1%, after a 3.4% drop in Q2. Following an aggressively hawkish November decision by the RBNZ, where it hiked the official cash rate (OCR) by 75bp (having considered 100bp) and lifted their forecast path by 140bp, survey data for December have been dreadful. Consumer and business confidence are reportedly at all-time lows. Firms' outlook for their own activity is consistent with recession. Even the labour market is showing early signs of easing, with a sharp drop in employment intentions and job advertisements. This is in keeping with RBNZ near-term goal, to drive the economy toward recession, so that inflation returns to target and the labour market returns to equilibrium.

What to watch

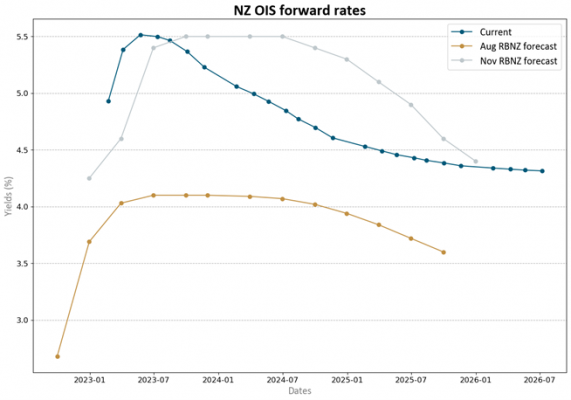

New Zealand financial markets don't currently believe the RBNZ’s forecast that the OCR will be above 5% for all of 2023 and 2024, but the risk is that might be what is required to return inflation to target. Instead, markets assume after reaching a peak of 5.5% in May, broadly in line with the RBNZ forecast peak, that the OCR will be cut by more than 100bp by the end of 2025. However, there is a risk that the RBNZ forecasts may turn out to be what is required to sufficiently loosen the labour market and return inflation to target – at the expense of economic growth. Core inflation and inflation expectations are sitting well above the top of the RBNZ's 1-3% inflation target band. The labour market remains tight and average hourly earnings are growing at 8.5% annualised. It is not clear how quickly a pick-up in net migration might help alleviate these pressures.

Source: Harbour, Bloomberg.

Market outlook and positioning

This macroeconomic backdrop provides a twisty path for equity market returns – the fire (central bank tightening) and ice (slowing growth) market dynamic is likely to continue in 2023. If inflation falls faster than expected, investors will anticipate central banks stepping back from increasing interest rates further which is positive for equity market valuations. But if inflation is falling because economic activity has declined more than expected, then equity markets may face a round of earnings forecast cuts. If inflation remains stubbornly sticky and economic activity remains strong, then central banks may continue to increase interest rates at a rapid rate, thereby continuing to hit equity market returns. Our research suggests 2023 should be icier as slowing growth becomes the bigger concern for stocks.

December’s bond market sell-off of longer maturity Government bonds reinforces that the bond vigilantes remain wary that inflation expectations can become unanchored, requiring higher interest rates to suppress demand-driven inflation. The potential for a further bond yield increase as inflation remains sticky continues to be a risk for equity market returns, but it may not be the risk to returns that it was over 2022, given where valuation multiples have moved with the equity market pullback.

The bigger risk for equity returns may be the profits/earnings-per-share recession which emerged in late 2022. With financial conditions tightening at their fastest pace since the ’70s/’80s, earnings risk has increased as operating leverage moves from being positive to negative for some stocks as economic activity slows and access to capital gets repriced to higher, more appropriate levels. Economic growth will likely moderate as 2022’s central bank policy tightening increases the cost of debt and slows demand. Europe may already be in recession and the US may see a modest recession over 2023. China’s reopening, after some initial challenges, may see better growth prospects develop over 2023.

Within equity growth portfolios, we remain focused on security analysis and looking through the cycle to identify attractive structural stock opportunities. Within the portfolio we continue to maintain a mix of investments in enduring growth stocks (including quality of defensive growth stocks in the healthcare sector that can sustain and grow returns through a period of slower cyclical economic activity), selected cyclical growth stocks (including financial stocks that have pricing power to deliver higher earnings in a period of higher inflation and increasing interest rates) and stocks that benefit from secular trends including demographic change, digitisation, industry disruption, decarbonisation (greenablers) and deglobalisation. Profitable technology stocks may be oversold and have potential to recover as earnings for cyclical companies get hit, and as central banks pause aggressive interest rate increases. The portfolio remains active, taking profits in investments when markets get ahead of fundamentals.

Within fixed interest portfolios, our view through 2022 had been that inflation would likely persist higher than market consensus, that the RBNZ would continue to hike rates, and that higher interest rates would prove to be challenging for households via mortgage rates, causing consumption and growth to slow, perhaps sharply. As we now look back on 2022, we have seen inflation go even higher than we anticipated, and the RBNZ hike more aggressively than we expected, while momentum in the economy held up better than we thought, primarily through strength in the labour market. Looking into 2023, with bond yields now pricing in tight monetary policy not only this year, but also into subsequent years, we expect the focus to shift more keenly to the economy, which we expect to slow as higher mortgage rates and other factors continue to put further downward pressure on the housing market. A weaker housing market could flow through into weaker spending, and the Government is likely to find it difficult to repeat the support and stimulus provided to households over the last 2 years. In time the labour market may soften and contribute to lower wage growth and a fall in price inflation. Given uncertainty in the lags of tighter policy through spending, employment and wages, we expect the RBNZ to be reticent in telegraphing rates cuts during 2023.

Within the Active Growth Fund, we hold a small underweight position to equities overall with a preference for growth stocks less exposed to the economic cycle. The Fund is also overweight interest rate duration. This reflects a view that economies are starting to respond to tighter monetary policy and central banks may not need to hike rates to the extent that is currently embedded in market pricing. The markets singular focus on interest rates and their implications on valuations has seen some, in our view, extreme market moves, leading to good active opportunities within equity markets.

Within the Income Fund, we have continued with a cautious approach to our investment strategy through the end of 2022. We had been underweight equity allocations in recent months, holding our allocation steady in November at around 28%, compared to a neutral weight of 32%. Equity markets outperformed fixed interest and cash over the last 3 -6 months, so there was a degree of missed opportunity over the period. We are holding an overweight fixed-income position in the 1 to 3-year maturity sector, based on the view that the risks are skewed towards the RBNZ not hiking as much as is priced into the market. Australasian credit is performing well, considering the economic backdrop, but we have adopted a somewhat more cautious view at present. Overall, we are now seeing both fixed income and equity markets more attractively priced, with our base case being that returns will be better in 2023.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.