- New Zealand is a small, open economy with a heavy reliance on the rest of the world for export revenue and funding.

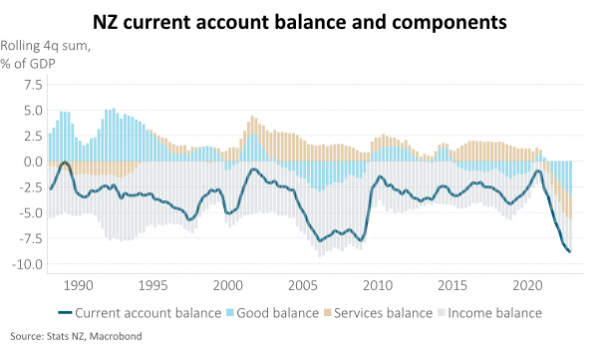

- The funding reliance is particularly acute currently as our tourism sector isn’t generating its normal amount of foreign revenue, pushing our current account balance to its largest deficit on record, almost 9% of GDP.

- While our current account balance should improve as tourists continue to return to New Zealand, in the interim it places us in a more sensitive position ahead of next month’s government Budget which is likely to show lower projected fiscal balances and higher government debt levels.

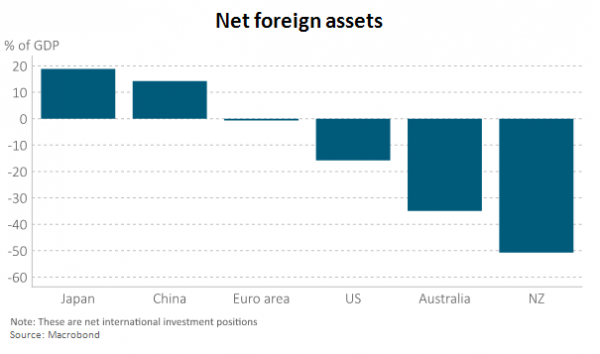

New Zealand is a small, open economy with a heavy reliance on the rest of the world for export revenue and funding. New Zealand exports are large as a proportion of our GDP (c.25%) which makes us sensitive to the health of the global economy and the price of our key commodity exports. Despite large export revenues, however, New Zealand has run a current account deficit for almost 50 years. This structural lack of domestic savings relative to investment demand has created a heavy reliance on foreign funding. The diversified and flexible nature of our economy, quality of our institutions, an independent central bank, floating exchange rate and strong rule of law are helpful in attracting foreign capital. Unlike other developed economies with a reliance on foreign creditors, our capital markets are shallow and provide less safety in a storm. We are also an economy that is vulnerable to natural disasters, notably earthquakes, and to disease that can negatively impact our large agricultural sector, e.g. foot and mouth disease. It is partly for these reasons that we must provide greater compensation to foreign investors. For example, our government bond yields have tended to be above those of the United States and the New Zealand dollar has generally had less purchasing power than the US dollar – despite New Zealand having a higher sovereign credit rating from S&P than the US, at AAA.

Funding of our current account deficit has come via a financial account surplus which includes both direct investment and portfolio (bonds and shares) investment. Foreigners, for example, own 60% of our government bonds. As a country, our international investment position shows we currently owe the rest of the world about 50% of our GDP, or $200bn, on a net basis. In other words, this is the total amount of foreign net borrowing we have across the public and private sector. The related interest and dividend payments we pay to the foreigners vastly exceed the earnings on foreign assets owned by New Zealanders, such that the income deficit, part of the current account balance, is currently equal to 3% of GDP. While this is a large number, it is an improvement on the 30-year average of 5% of GDP.

The unusual thing about our current balance of payments is that our trade balance is in deficit due to weakness in tourism revenue. A positive services balance (largely driven by tourism) usually contributes 1-2% of GDP to our trade balance, such that our overall export revenue is more than enough to cover the cost of our imports. Our tourism sector is still in the process of post-COVID recovery and our services trade balance is in deficit of more than 2% of GDP, contributing to an overall trade deficit of more than 5% of GDP. This has resulted in a record large current account deficit of almost 9% of GDP.

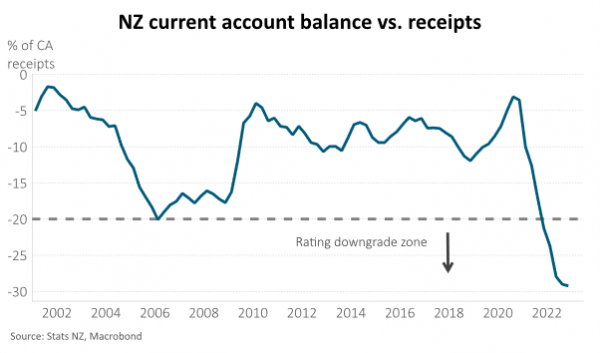

While the current account deficit should become smaller over the next year as tourism continues to rebound and a slowing domestic economy reduces import demand, it still needs to be funded and will be an ongoing focus for rating agencies. The metric that ratings agencies are expecting to improve meaningfully is New Zealand's funding need as a proportion of its foreign revenue. Specifically, this is the current account deficit as a proportion of current account receipts. If it doesn’t, there is the possibility of a credit downgrade with S&P saying in its latest update (September 2022) that our rating could be lowered “if the country has persistently weak current account deficits of more than 20% of current receipts”. New Zealand is already suffering from a negative adjustment by S&P to its external risks due to short-term debt exceeding 100% of current account receipts.

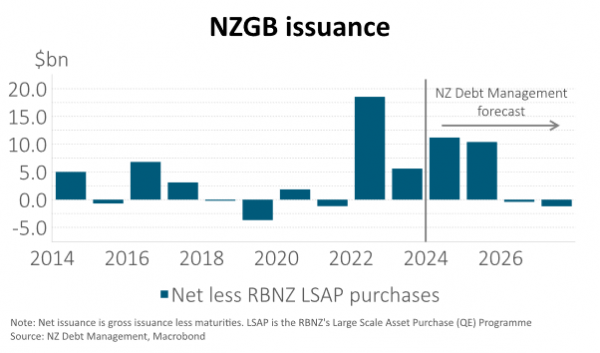

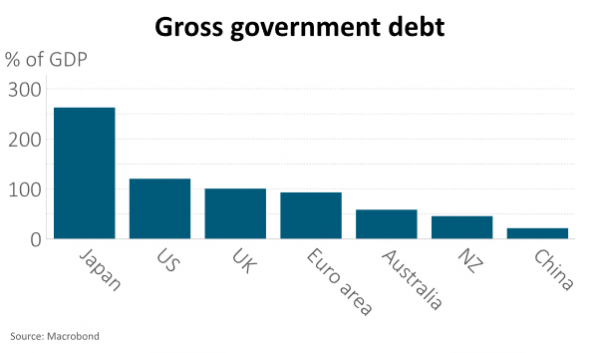

This places New Zealand in a more sensitive position ahead of a Budget that is likely to show lower projected fiscal balances and higher government debt levels. The last update from the Government at the end of last year showed fiscal deficits for the current fiscal year ending June, and the next, before returning to surplus in the fiscal year ending June 2025. Recent comments from Finance Minister, Grant Robertson, suggest the 18 May Budget will include a North Island flood rebuild package worth approximately $9-10bn. There is also the indication of support for people facing cost-of-living challenges. While some reprioritisation of spending is likely, a portion of this will likely result in lower projected fiscal – larger deficits in the near term and smaller surpluses further out. This is likely to require additional funding, including from foreigners. Given an already-large government bond issuance programme, particularly over the next two fiscal years, higher yields versus other countries and/or a weaker exchange rate may be required to attract additional buyers of government bonds. There is a likely limit to this adjustment, however, as our government debt is very low relative to other countries at less than 50% of GDP in gross terms and less than 20% in net terms.

Definition of terms

Current account balance = Goods balance + services balance + income balance

Goods balance = Exports of goods – imports of goods

Services balance = Exports of services – imports of services

Income balance = Interest and dividend payments made to New Zealand holders of foreign assets – interest and dividend payments made to foreign holders of NZ assets

Financial account balance = Foreign investment in NZ - NZ investment abroad

Net international investment position = NZ foreign assets – NZ foreign liabilities

Fiscal balance = Government revenue – government expenses

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.