- Harbour’s core equity portfolios have a “growth” bias. Our investment process has multiple steps which includes assessing key secular trends that are underappreciated. Some people call these themes megatrends.

- Secular trends tend to be long-lasting, as they transcend industry shifts and cyclical economic activity, and ultimately lead to sustained growth.

- At Harbour our core equity growth investment process has a focus on the ’D’ megatrends; demographics, disruption, digitisation, decarbonisation and deglobalisation.

Harbour’s approach to managing active equity growth funds is to focus on quality growth stocks, because research shows that growth stocks ride through most cycles. This involves assessing secular trends where growth is underappreciated, both in terms of stocks delivering higher-than-expected earnings growth, and where growth has the potential to last longer than the market expects. Some people call these megatrends.

We are pragmatic about where growth comes from - we like to have a diversified portfolio of stocks from across the growth spectrum including cyclical growth and durable growth investments.

Cyclical stock performance tends to be correlated with the state of the economy. When the economy does well, the company does well, and vice versa. A good example of an industry group that benefits from cyclical trends is the building materials industry where the ability to leverage fixed operating costs amplifies potential profit growth.

Over the long term, businesses that benefit from secular themes are often underappreciated. Businesses that benefit from underlying forces that are less related to the state of the economy tend to have a higher return on invested capital. Secular trends tend to be long lasting, as they transcend industry shifts and cyclical economic activity, and ultimately lead to sustained growth. A good example of an industry group that benefits from secular trends is the healthcare industry which benefits from aging populations and technology disruptions.

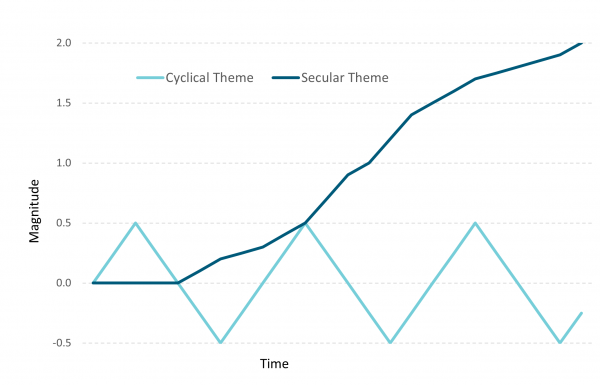

At Harbour, we believe long-term investors should focus on identifying secular themes rather than cyclical ones. Given their longer term and disruptive nature, research suggests that secular themes can be less dependent on timing the entry and exit points and can be more powerful in magnitude over time.

Cyclical and secular themes have differing growth paths and growth magnitudes through time

Source: Harbour Asset Management. For illustrative purposes – not based on actual data.

Where are the long-term secular tailwinds?

Secular tailwinds tend to move at a glacial pace. At Harbour our current focus is on the ‘D’ megatrends; demographics, disruption, digitisation, decarbonisation and deglobalisation.

- Demographics – in particular, the two big age cohorts are the Baby Boomers (who are directing their wealth to retirement and healthcare), and Generation Z (the 10–20-year-old age group who are focused on education and entering the work force).

- Disruption – whereby new economic models are disrupting existing industries.

- Digitisation – where low-cost compute power is accelerating the pace of change within industries as information flows improve.

- Decarbonisation – with the move to reduce carbon intensity having implications for revenue growth, cost growth, return on capital and even the right to operate.

- Deglobalisation – where we are seeing an unwind of trends such as global manufacturing outsourcing as economies and businesses focus on becoming more resilient by becoming less dependent on trade lanes.

These tailwinds are more likely to drive earnings whether economic activity is strong or slow.

How does Harbour invest in these secular tailwinds?

A good example of how Harbour invests in secular tailwinds is to consider one of the D’s – Demographics.

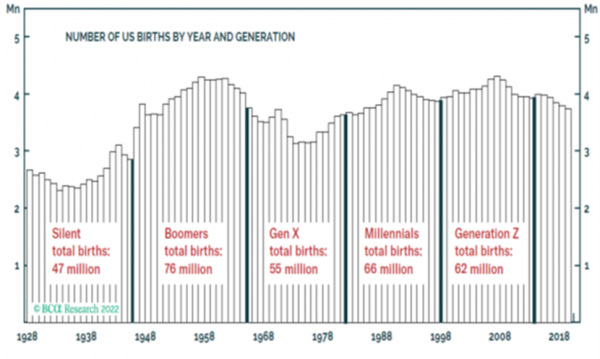

Understanding population bubbles can help us understand stocks that may benefit from accelerated demand as various generations work their way through. There are two large demographic groups in Figure 2 which shows the number of births by year and generation – the Baby Boomers generation and Generation Z (Gen Z).

Demographic trends: Young & young at heart

Source: BCA The Milwaukee Independent, aecf.org

Most people know about the Baby Boomer generation, but Gen Z is less well known. Generation Z was born in the late 1990’s - early 2010’s (so the oldest Gen Z is 25ish, and the youngest is 10ish). Gen Zs are the first 100% digital natives – they have never known a world without smart phones and information everywhere all the time.

Because Gen Zs have grown up in a period of economic turbulence, they are more concerned than older generations about academic performance and job prospects which is driving demand for tertiary education. That demand for education is hottest in emerging economies where Gen Z is often an even bigger part of the population.

So, how do we invest Gen Z’s thirst for education?

The purpose of this note is not to provide investment advice. But we illustrate the influence of the secular trend of the growth in Gen Z through the Australian listed company, IDP Education. IDP Education provides a key pathway for international Gen Z students seeking to further their education in leading educational institutions.

IDP does this in two ways:

- As the part owner of the International English Language Testing System (IELTS test) - the world’s most popular language proficiency test– IDP benefits from students (where English is not their first language) who are starting their international education journey.

- IDP earns fees by being a leading student placement provider with 900+ counsellors guiding students and their families through the course selection and application process.

With more than 120 offices in over 30 countries IDP has the leading footprint in emerging Asia, Middle East, and Africa where wealth is on the rise and population growth is constructive for education demand. IDP partners with (and is often the preferred partner of) over 700 leading educational institutions.

IDP has a best-in-class digital ecosystem, enabling a bigger reach of students with more efficient processing of visa and student applications (remember Gen Z are digital first), so a good digital offer is key to winning their business.

If a person in an emerging economy is wanting to further their education in one of the top education institutions globally, they will probably consider IDP as being part of that process.

Harbour’s overall view on growth equities is to invest in longer-term trends, be active and diversify.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.