- After an aggressive RBNZ tightening cycle, the New Zealand economy is likely to enter recession later this year.

- Inflation, however, is unlikely to quickly return to the RBNZ’s 1-3% target range and involves three broad steps – supply chain normalisation, lower housing costs and a drop in wage growth. Only the first step is complete.

- We expect the RBNZ to increasingly recognise the impact of its rapid rate hikes to highly restrictive territory and the lags with which these work their way through the economy. As such, we think it is close to the end of its tightening cycle and is likely to begin cutting rates at the end of this year.

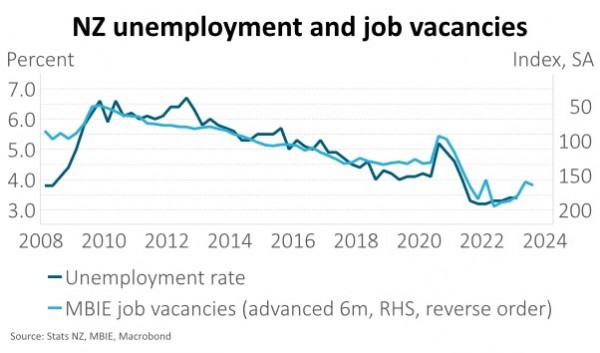

After 500bps of Reserve Bank of New Zealand (RBNZ) rate hikes since October 2021, taking the Official Cash Rate (OCR) to 5.25%, the New Zealand economy is likely to enter recession this year. Leading indicators suggest monetary policy is working. Price and wage inflation on a quarterly basis are dropping. Job openings have fallen and are consistent with a rise in the unemployment rate towards 4% over the next few months, from 3.4% currently. The housing market continues to soften, and prices remain well above the fair value implied by historical house price-to-income ratios and the percentage of income required to service a mortgage for a new buyer. Further house price declines are likely as high mortgage rates bite and unemployment picks up. Almost 50% of outstanding mortgages are due to re-fix over the coming year. The outlook for residential investment is particularly poor. The RBNZ forecasts a 15% contraction in the sector, beginning this quarter. Households are likely to continue reducing consumption and increasing savings as the economic outlook darkens and balance sheets lose value. While the Chinese economy is benefitting from its recent reopening, we expect overall trading partner growth and export commodity prices to decline over the next 12 months, as tight global monetary policy bites. The rebuild from the North Island floods will likely add to activity over the next 2-3 years but won’t be enough for the economy to avoid recession, in our view.

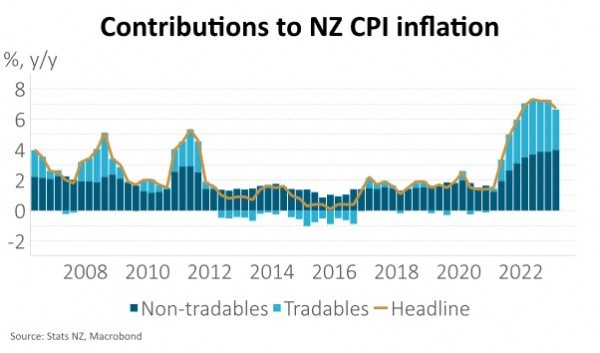

Inflation, however, is unlikely to quickly return to the RBNZ’s 1-3% target range. Aside from the prospect that structural disinflation forces may be reversing (discussed more here), there are three steps required for inflation to return to more normal levels, of which only the first is complete:

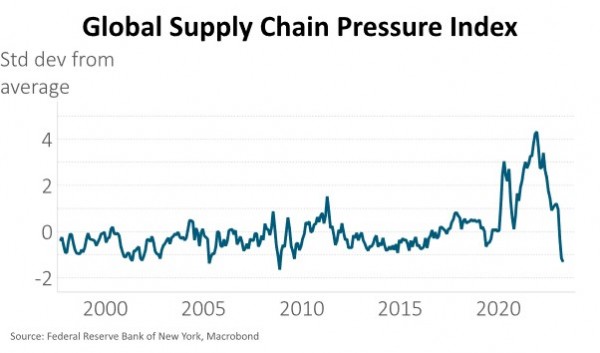

1. A normalisation of global supply chains after COVID-led disruption. This has largely happened, and along with lower commodity prices, is likely to provide a helpful tradable disinflation force such that tradable inflation (40% of the Consumers Price Index, CPI) is likely to approach zero over the next year. This should reduce headline inflation from the current 6.7% y/y to around 4% y/y – good progress, but still double the RBNZ’s 2% target!

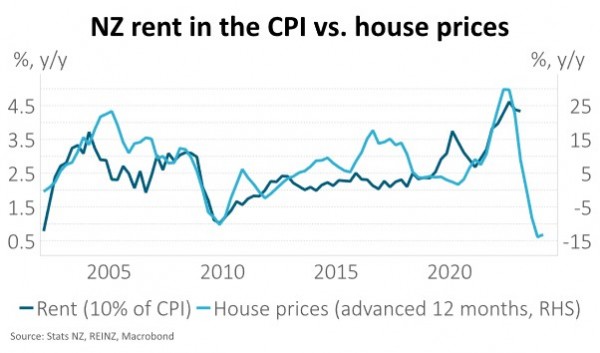

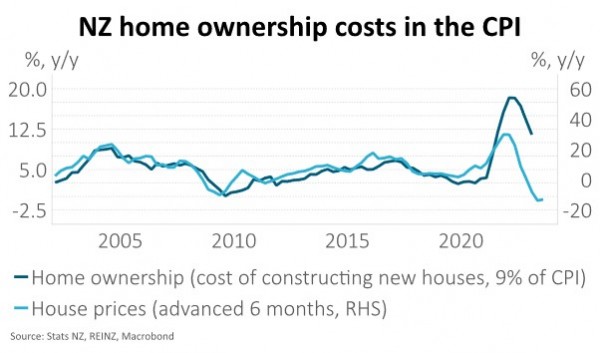

2. Lower house prices reducing rents, residential investment, and the cost of building a new home. This has only partly occurred. House prices have fallen more than 16% from their November 2021 peak but rents within the CPI (10% of the CPI) are still growing at more than 4% y/y. New rent prices, however, are increasing at less than 3% per annum. The fall in house prices experienced so far suggest that rent inflation should drop towards 1% y/y over the next year. Similarly, the cost of building a new home (“home ownership” costs in the CPI, making up 9% of index) is growing at more than 14% y/y, but the decline experienced in house prices suggests this should approach zero over the coming year. There is however a strong caveat here, with significant migration flows suggesting we may see home ownership costs fall more readily than rents.

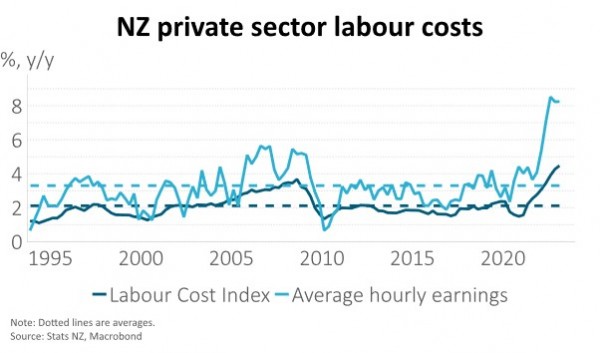

3. A loosening of the labour market (less job ads, higher unemployment) leading to lower wage growth. This is only just beginning. Job advertisements are dropping but the unemployment rate is just 3.4%, close to record-lows of 3.2%. Wages growth remains rapid – more than 8% annually for average hourly earnings, for example. Lower wage growth will be key in lowering non-tradable inflation (60% of CPI) as these prices are largely for services, for which labour forms the biggest input cost.

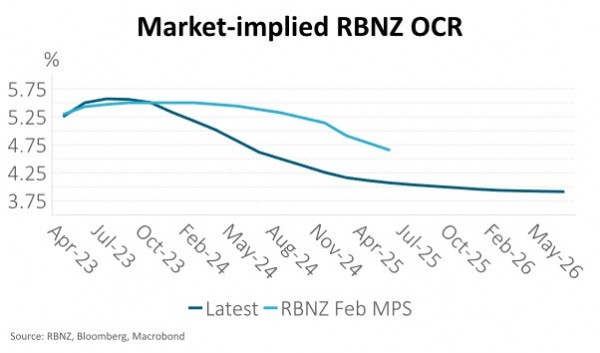

We expect the RBNZ to increasingly recognise the impact of its rapid rate hikes to highly restrictive levels and the lags with which these work their way through the economy. As such, we think it is close to the end of its tightening cycle and is likely to begin cutting rates at the end of this year. While it will take time for inflation to return to target, we think monetary conditions are sufficiently tight to get inflation a lot lower and policy won’t need to remain this restrictive for as long as the RBNZ assumes. The RBNZ February Monetary Policy Statement forecast the OCR (Official Cash Rate) to be above 5% for the next two years. Markets imply the OCR to be about 4% by the beginning of 2025, a view we have much more sympathy with and one that still implies tight monetary policy for a considerable period.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.