|

|

|

After a few weeks of global banking turmoil we travelled to Australia this week to talk with banks and other financial institutions and attended the Australian Financial Review (AFR) Banking Summit. Over 450 financial leaders heard from CBA and Westpac CEOs, and the full gamut of financial regulators: the RBA, APRA, ASIC and the ACCC. These are our key takeaways.

Banks pass their stress test

Regulators, such as the Reserve Bank of Australia (RBA) and Australia’s independent financial regulator, Australian Prudential Regulation Authority (APRA), conduct regular stress tests of the financial system. These tests are not made based on reasonable forecasts, instead they represent a test of the financial system under extraordinary circumstances that appear almost implausible. And it is not often you have the regulator make a doomsday stress test the core of the storyline at a financial summit. But it was a very effective demonstration. The Chair of APRA led us to imagine a world where Australia experiences GDP sliding 4%, house prices falling over 40%, and unemployment rising to 11%. Once you’ve considered that environment, top it off with each major bank succumbing to a major cyber-attack. Many borrowers under that stress test will miss repayments and fall into a trapped negative equity position. Bank profits would disappear, and dividends would be halted. Despite this, APRA said that their modelling would have banks still retaining equity above minimum standards, meaning depositors would remain safe in the system. And of course, Australian retail depositors are also protected by up to A$250,000 per account-holder for each authorised deposit-taking institution through their Financial Claims Scheme (FCS). The major five banks pay a 6bp levy applied to certain liabilities to assist funding protections for depositors.

As if to drum home these points, Peter King and Matt Comyn, respective CEOs of Westpac Bank and Commonwealth Bank, contrasted the difference in the financial strengths of banks today compared with 2008. In 2008 Westpac, following their acquisition of St. George Bank, had Tier 1 capital (equity) of only 4%; today that’s over 11%. CBA’s Tier 1 capital at the end of December 2022 was even higher at 12.1%. These capital positions are “unquestionably strong”. Matt Comyn said that the big four Australian banks were among the top five best capitalised banks in the world, holding collectively 2.5 times the regulatory capital they held in 2008.

The key perspective that caught out some smaller US regional banks in particular in recent weeks were losses in their asset books, timed with a large-scale rapid run in deposits, despite a similar deposit insurance scheme up to US$250,000. Bank book losses occurred in the US as smaller regional banks were not required to mark to market the value of their assets (in this case, principally liquid government bonds bought when interest rates were a lot lower, and hence bond prices were a lot higher).

In Australia, banks have to mark their bond holdings to market and hedge their interest rate risk or be subject to additional capital charges. This prudential rule (IRRBB or interest rate risk in the banking book) stands apart from other banking jurisdictions and means that swings in asset values due to interest rate volatility are either largely “hedged” or that a capital charge is required to cover those losses even if they are only book losses.

But Comyn went on to say that there is “no magic pudding” in using ratios, solvency, liquidity or capital standards. Strong lending standards, a high proportion of retail deposits and a lengthening in wholesale funding maturities were all important tools to create a resilient banking system.

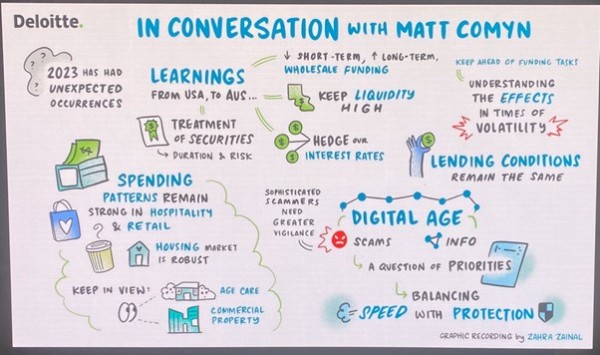

Source: AFR Banking Summit March 2023. Matt Comyn, CEO of Commonwealth Bank spoke at the recent AFR Banking Summit in Sydney

As an example, King noted that short term funding was 25% of Westpac’s book in 2008, now it is less than 7%. Moreover, like other banks, the proportion of interest-only loans has plummeted, and in Westpac’s case from 50% of their mortgage book to less than 15%. This means that the majority of mortgage loans are amortising, and households generally have some greater flexibility in their pre-payments of principal on mortgages. Additionally, APRA still forces all home lenders to place a modelled stress on borrowers of a 3% home loan service ability buffer over and above the variable home loan rate before a lending decision is made. So, for instance if the variable rate loan is 5%, the stress rate that banks have to use to ascertain whether a borrower can afford the loan is 8%. This interest rate buffer does not obviate the financial pain for households from the recent sharp 3-4% rise in interest rates but, unlike other jurisdictions, it ought to limit widespread delinquencies or impairments providing rising unemployment rates remain subdued.

Finally, concerns regarding the Australian banks’ access to wholesale markets was also alleviated this week when ANZ raised $4.25bn in the bond markets at a reasonable funding cost this week easing any fading near-term concerns about financial stability in Australia.

Areas of concern: where is the mortgage stress?

Banks are looking carefully into the fog ahead for signs of mortgage stress. Today in Australia, lenders and mortgage brokers we spoke to see no clear trend of increasing delinquencies, but all fear the next few months. Factors limiting the concerns are full employment and a significant lift in wages and salaries. However, there are also clear signs of a significant slowdown in consumer spending in Australia. Households will peel back their spending before missing a mortgage payment, and the warning remains that impairments are likely to rise.

To some extent, mortgage competition in Australia is also alleviating some of the mortgage pain. Some borrowers are buying time through mortgage switching. Analysts we spoke to highlighted extraordinary discounts of 0.40% to 0.90% on the variable mortgage rate and cash back offers between $2,500 and $5,000 to retain or switch your mortgage. Hence, headline 6%-plus floating rate mortgages are closer to a 5.25% effective mortgage rate for many Australian households. Contrast that with the position of many New Zealand borrowers who have been rolling off sub-3% fixed rate mortgages onto 7.25% to 7.5% floating rate loans.

The commercial real estate sector continues to be cited by banks and analysts as having a weakening financial trend. This seems to be the case for buildings in the outer ring of cities, but also for B- and C-grade CBD buildings. Australian banks have significantly pulled back on lending to this sector. Instead, global banks and private credit providers have picked up the lending. There is some concern for loan rollovers and capitalisation rates in the commercial property sector in Australia. Higher capitalisation rates and, likely, much higher interest rate resets will stress some borrowers as they refinance. But this financial stress is typical following a tightening of monetary policy. It is possible that cashed-up buyers may, at some point, be poised to provide liquidity to the commercial real estate sector. The noise from the major banks was that their sector exposures are manageable, and their loan loss provisions generally anticipated stress would increase.

Has the Reserve Bank of Australia finished increasing interest rates?

Without doubt, the RBA has driven a consistent and patient course in lifting interest rates compared to other central banks. There hasn’t been any source of panic, just steady 0.25% rises at each of the last five meetings.

In recent weeks the market has started to call the end of the rate cycle in Australia, with mounting evidence of a weakening consumer, and much higher migration expected to lead to higher unemployment and perhaps less wage strain. For some, the dovish path of the RBA has been seen as a challenge to credibility, but this week some early signs of inflation declining more quickly than expected leaned into the view that the RBA might be almost done for rate rises.

It seems quite astonishing, as aligned with that view is a strong perspective that the Australian economy may also avoid a recession, buoyed by its strong export base and an openness to migration. It also seems helpful that a trade dialogue with China has recommenced after a very chilly three years. Whatever the case, fewer supply chain obstructions could also be another factor in lowering Australia’s inflation outlook, helping the RBA negotiate the next few months at a likely top of the interest rate cycle.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.