- China’s economic and demographic imbalances have increased during COVID which may pose challenges for long-term growth. However, the near-term reopening of China’s post-COVID economy will likely have profound impacts for many New Zealand and Australian companies.

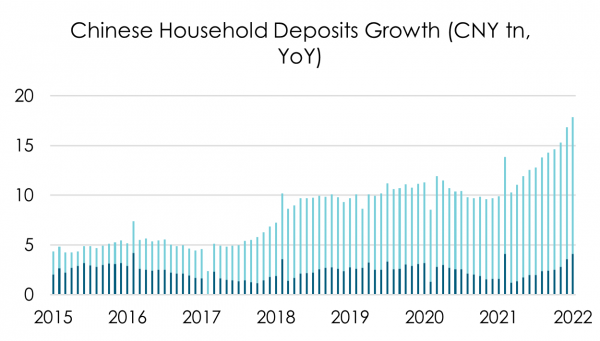

- The Chinese consumer is cashed up with record deposit growth during the COVID era. Although the overall household balance sheet has seen asset price declines, very high cash on deposit balances are the primary firepower for ‘revenge spending’ post COVID.

- Should our views be correct of a stronger Chinese consumer - who is willing to get out and explore the world again - there may be profound benefits for several companies listed on the ASX or NZX across education, viticulture, horticulture, battery materials and others.

The reopening of China will likely have far-reaching impacts for many Kiwi companies.

Looking back three months there were few signs that China would be reopening its economy in earnest. In 2022 policymakers were regularly reminding us of a ‘people over the economy’ stance, with no tangible reopening plan in place.

Fast forward to today and the reopening of the world’s second largest economy is well advanced with no going back to the days of lockdowns. The road to normalisation will no doubt be bumpy, with managing health outcomes, economic imbalances and political stability at question, both at home and abroad. However, we believe that the direction of travel is a positive one, where the Chinese can once again get on with their lives without stringent mobility restrictions.

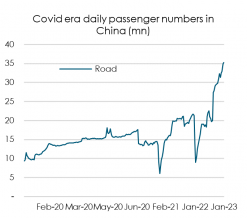

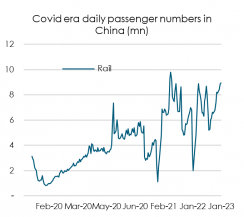

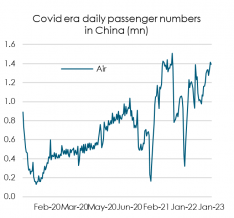

There is a clear acceleration in the mobility indices since the lockdown policies started easing:

Source: Bloomberg, Ministry of Transport, Harbour

China’s economic and demographic imbalances have increased during COVID which may pose challenges for long-term growth. However, the near-term reopening of China’s post-COVID economy may have profound impacts for many New Zealand and Australian companies.

Tourism and international student flows may be primary beneficiaries of returning Chinese travellers and students. Other sectors that could benefit include wine, honey and dairy, which are typical favourites of Chinese consumers. We also believe battery materials and selected other commodities could see improved demand as China’s domestic consumption picks up.

Chinese heavy industry and manufacturing sectors have largely operated as normal during COVID restrictions, ensuring continuity of an important driver of economic output. Also, infrastructure investment has been very strong with the Government flexing its muscles to ensure this sector helps offset the weakness in property and consumption. This infrastructure investment has seen industries like steel and power-generation stay strong – a major benefit for Australian bulk mining companies enjoying robust pricing for their respective commodities.

Chinese property is by no means out of the woods and could take years to start contributing meaningfully to GDP growth again. However, significant policy easing is targeting the sector and it is our view that the property sector may be getting closer to the bottom and should provide an incrementally smaller drag on growth going forward. What happens to the Chinese consumer in the next 12-18 months will inform our view on the property sector.

In a pure economic sense, the Chinese consumer has taken the biggest hit during COVID, losing confidence in the economy, future employment prospects, and the healthcare system. It can be argued that the Chinese consumer may react more conservatively to the reopening than other nations, given increased needs to self-insure social services (health, education and aged care) relative to Western nations, coupled with a negative wealth effect from lower asset prices. However, it seems likely that the Chinese consumer market will mimic the sharp recovery of other nations and, once the non-manufacturing economy regains a heartbeat, there could be demand growth beyond the expected pent-up demand from a reopening economy.

The Chinese consumer is cashed up with record deposit growth during the COVID era. Although the overall household balance sheet has seen asset price declines, very high cash on deposit balances are the primary firepower for ‘revenge spending’ post COVID. Dining out with friends, going to the movies, travelling, or going abroad to study have been largely off the menu in the last three years. As the Chinese incrementally regain confidence, we expect them to pick up old habits and binge on some of these long-lost indulgences. This bodes well for many companies in Australia and New Zealand, with Chinese consumers recognising our products, services, and natural environment as some of the best in the world.

Source: Bloomberg, ANZ, Harbour

It has always been surprising how negative sentiment can get when it comes to China’s economy. We are at one of these junctures now, where the spread of views is extremely wide, with forceful views on both sides of the ledger. This means that, should our views be correct of a stronger Chinese consumer who is willing to get out and explore the world again, there may be profound benefits for several companies listed on the ASX or NZX across education, viticulture, horticulture, battery materials and others.

We are looking to March’s National People’s Congress, the largest policy conference on the China Communist Party’s annual schedule, as a major launchpad for specific policy announcements – many of which would dictate the pace of sector performances in 2023 and beyond.

In the meantime, we continue to monitor data, policy developments, sentiment indicators and corporate news to gauge the opportunities from the Chinese reopening that we think could impact far beyond China’s own borders.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.