- New Zealand bank funding costs are likely to rise over the next 1-2 years as the Reserve Bank of New Zealand (RBNZ) unwinds its liquidity provision measures introduced in response to COVID-19.

- As financial system cash reduces, banks will look to attract alternative sources of funding. Therefore, retail interest rates will likely be pressured higher, independent of any changes in the OCR.

- We think this ought to encourage a more cautious approach from the RBNZ and strengthens our view that the OCR is unlikely to reach the 5% peak that markets currently expect.

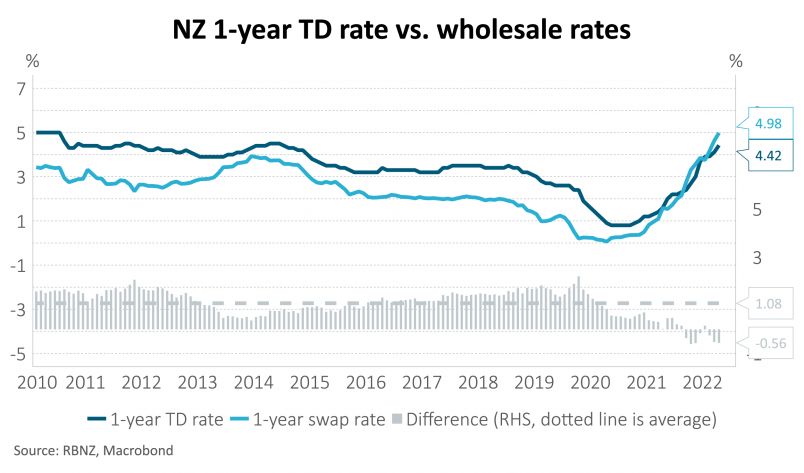

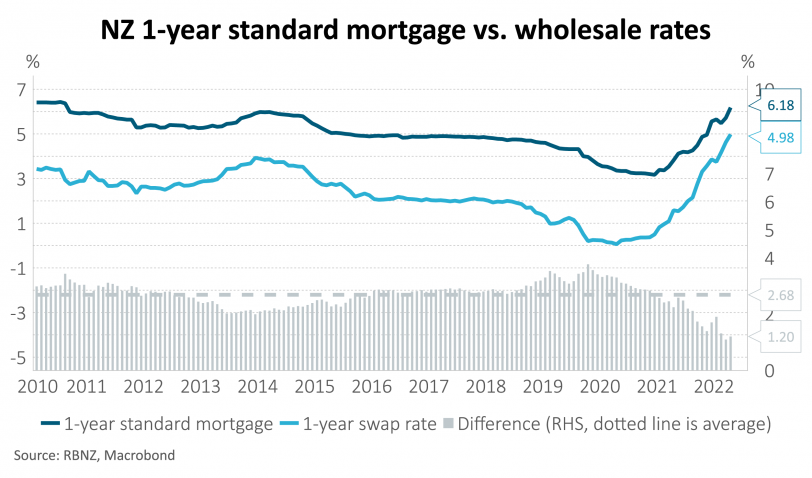

New Zealand bank funding costs are likely to rise over the next 1-2 years as the RBNZ’s Funding for Lending Programme (FLP) expires and it withdraws financial system liquidity via “Quantitative Tightening”. The RBNZ’s Large Scale Asset Purchase (LSAP) programme is our central bank’s version of quantitative easing (QE) or bond buying. The FLP is another programme that injects liquidity by offering banks 3-year loans at a floating interest rate equal to the Official Cash Rate (OCR). Together, these programmes have injected almost $60bn into the financial system, providing banks with large amounts of deposits. This abundance of liquidity has caused retail interest rates to exhibit unusually low spreads to wholesale rates (see chart below), hence perhaps why term deposit (TD) rates have reacted more slowly than mortgage and lending rates to the rising OCR.

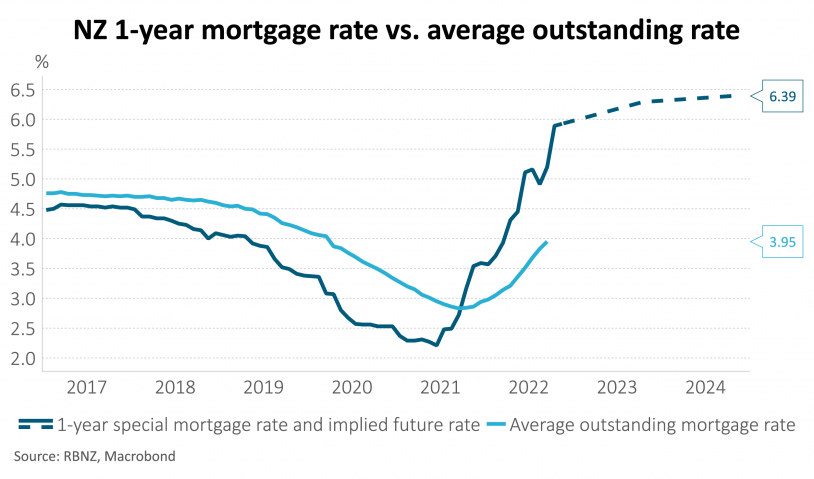

The RBNZ, however, will close the FLP on 6 December and in July this year started to reduce its holdings of government and Local Government Funding Agency bonds at a rate of $5bn/year, plus maturities. The RBNZ balance sheet will reduce at an average rate of $11.5bn/year over the next three years. This implies a steady reduction in financial system cash that will likely provide upward pressure on retail interest rates, all else equal.

As financial system cash reduces, banks may look to attract alternative sources of funding. Therefore, retail interest rates may be pressured higher, independent of any changes in the OCR. The state of the economy may influence the speed of this adjustment, however. For example, the pressure on interest rates to rise may be less if the demand for new borrowing is low due to poor economic growth.

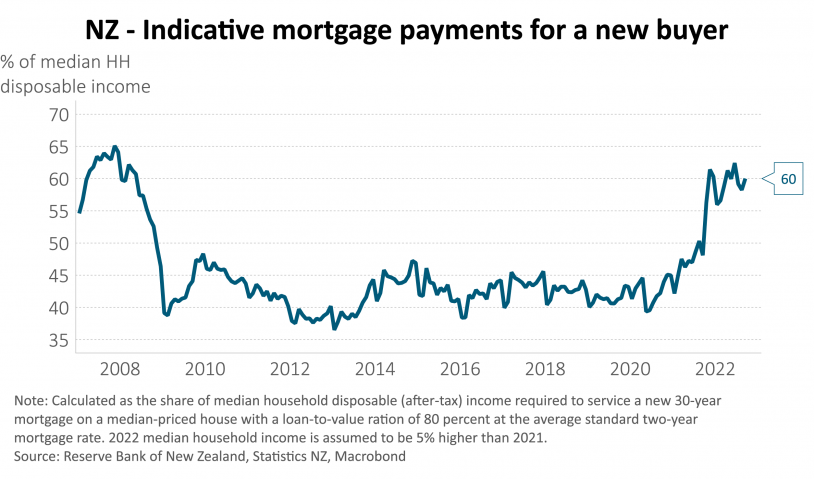

We think this ought to encourage a more cautious approach from the RBNZ and strengthens our view that the OCR is unlikely to reach the 5% peak that markets currently expect. Our base case is for a peak OCR of 4.5%, about 40bp higher than the August Monetary Policy Statement forecast. Despite strong job security and rising wages, the economy is beginning to respond to tighter monetary policy – particularly higher mortgage rates (see charts below). Data released in October confirmed that households increased their rate of savings by reducing consumption in Q2. This behaviour is consistent with the increasingly challenging economic outlook and large wealth losses households have experienced this year. We think further reductions in consumption are likely. House prices have fallen 11% from their peak in November 2021. Further falls may happen as mortgage rates continue to increase and more borrowers are exposed to higher rates. Very low population growth due to meek migration is also a negative driver for house prices and the outlook for residential investment.

Important Notice and Disclaimer

This presentation is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.