Key Points

- The Reserve Bank of New Zealand (RBNZ) has found a fiscal friend in the past two months. Following the $12bn of capital spending announced in the Government’s December Budget, Kāinga Ora (Housing NZ’s parent) plans to borrow an additional $4bn to help its state housing efforts.

- While there is uncertainty about delivery, any additional government capital spending is likely to add to inflation via increased construction demand.

- RBNZ rate cuts are less likely as a result and activity indicators are already picking up. Rate hikes remain a long way off however, with still-low inflation suggesting the RBNZ can adopt a patient approach.

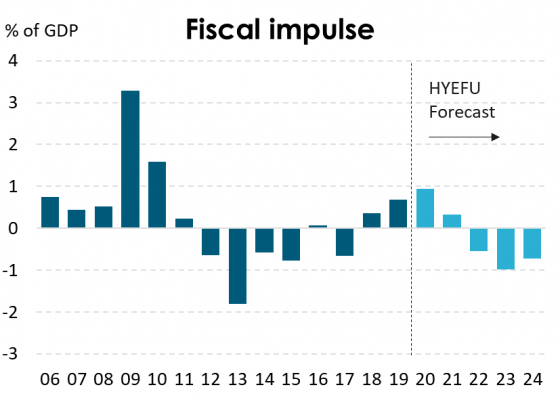

The Government has substantially increased its spending plans over the past two months, turning out to be a better friend to the RBNZ in supporting economic activity than most had anticipated. Not only did the December 2019 Half-Yearly Economic and Fiscal Update (HYEFU) unveil a capital spending package worth $12bn (adding 1.4% to real GDP over the next four years), Kāinga Ora announced on January 19th an additional $4bn of borrowing to help its ongoing state housing upgrades. Kāinga Ora raised its borrowing limit to $7.10bn, from $3.05bn, and intends to use most of this new limit over the next two years to help finance “much-needed warm, dry and safe houses across New Zealand”. In its latest (September 2019) investor update, the government agency planned to build 7,500 new homes over the next four years, and upgrade or replace 45,000 homes (c.70% of current stock) over the next two decades. We noted in September, after the OCR had plumbed new lows, that fiscal policy was better placed to provide additional economic stimulus (see NZ Monetary Policy: Diminishing Returns, 26 September 2019).

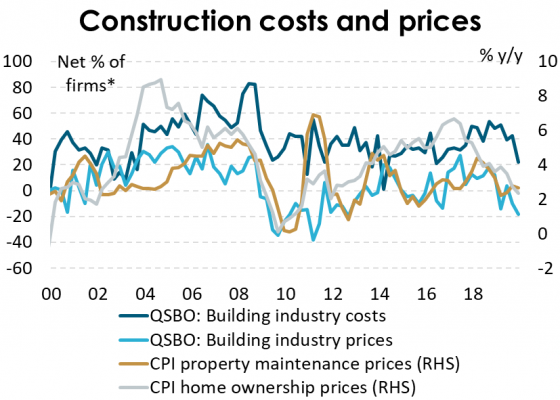

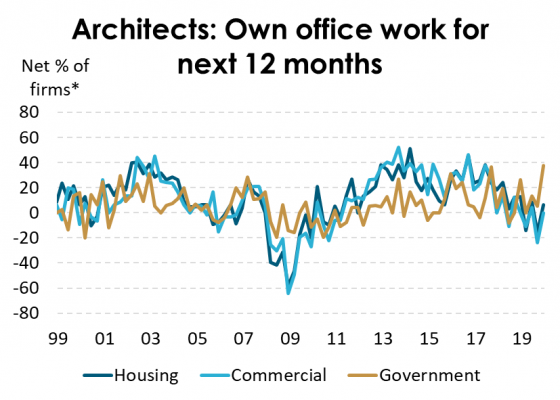

While there is uncertainty about delivery, any additional government capital spending is likely to add to inflation via increased construction demand. Faced with rising costs and tighter operating margins, the construction sector must be keen to pass on cost rises. However, strong competition and insufficient demand has made this difficult. The December ANZ Business Confidence survey, for example, showed the construction sector had the second-highest cost escalation, but the lowest intentions to increase prices – a story supported by the December quarter New Zealand Institute of Economic Research Quarterly Survey of Business Opinion (NZIER QSBO) survey, along with property maintenance and home ownership inflation within the CPI. With additional government demand in this area, prices are unlikely to decline. The QSBO survey reported a strong pickup in architects’ pipeline of work for government, likely reflecting the new government spending plans. The recent pickup in house prices and activity is also likely to add to demand in this sector.

We think this materially weakens the case for further RBNZ rate cuts. Activity indicators have picked up in recent months and, prior to the Kāinga Ora announcement, fiscal spending was already forecast to make the largest contribution to GDP over the next two years since 2010. We estimate that the combined impact of government capital spending announced at the December HYEFU, and an additional $4bn of state housing spending (assumed to be spread evenly over the next four years) should raise the November Monetary Policy Statement (MPS) OCR forecast track by as much as 50 basis points (bp) at the Q4 2021 point (from 1.15% to 1.65%), after controlling for the associated crowding out of private sector investment. Rate hikes remain a long way off however, with still-low inflation suggesting the RBNZ can adopt a patient approach. Both the RBNZ’s preferred core measure of inflation (the sectoral factor model) and surveyed two-year ahead measure are 1.8% y/y, below the midpoint of the central bank’s 1-3% target range.

* Net % of firms that experienced an increase in costs and prices.

Source: NZIER Q4 QSBO, Statistics NZ. For reference, property maintenance and home ownership prices make up 3% and 5% of the CPI, respectively.

* Net % of firms that expect an increase in own office work over the next 12 months.

Source: NZIER Q4 QSBO.

Source: NZ Treasury Half-Yearly Economic and Fiscal Update.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.