Source: Weekly Times

The a2 Milk Company reported on earnings last Wednesday. In spite of net profit 47% ahead of last year with a 41% increase in revenue, the market was disappointed by reduced margins, reportedly due to increased spending on marketing and, as a consequence, the price has fallen.

- a2 spent more on marketing and product development than expected

- We see this as building the foundation to be a global leader in dairy nutrition

- Significant runway remains in both China and the US

a2 Milk remains Harbour’s highest conviction position in equity growth portfolios. Despite the price fall after announcing its annual results, the share price today is still up 28% so far in 2019.

Our view is unchanged that a2 Milk is on a journey to become a global leader in dairy nutrition. Yesterday’s announcement to significantly increase investment in market development gives us confidence that they are prepared to sacrifice short-term gains in order to pursue large growth options. a2 Milk offers consumers a unique product proposition sitting strongly in the fast-growing healthy alternative category for nutrition.

The result

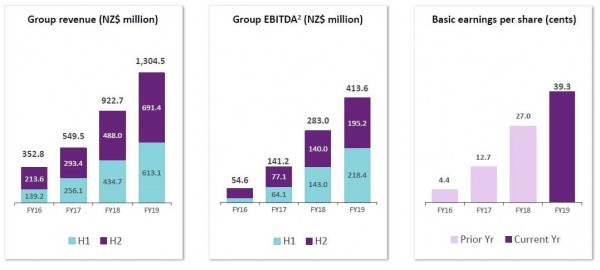

The result itself was broadly in line with market expectations, with a slight miss on revenue (-1%), a slight beat on gross margin, and in line with EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margin guidance.

Source: a2 Milk annual result presentation

The miss came from a2 spending more on marketing and product development than expected. As a result, the announced earnings were about 3% behind market expectations.

However, as the US/UK business segment is a growth option that is currently losing money, we would like to know what the profitability is for the ‘core’ business only (without the US/UK). This is an option that a2 Milk could eventually walk away from (we think not) and a segment that a potential suitor might choose to discontinue.

Looking at the core business only, the margins were 35.1% for the full fiscal year (also adjusted for one-off costs associated with the CEO changes and the UK impairment of assets) versus the reported 31.7%. Similarly, in the second half of the fiscal year, margins in the core business were 31.9% versus the 28.2% reported.[1]

We also note that the inventory ‘in transit’ was $30.6mn higher at balance date than last year. We do not know the timing of this but assume it would have been converted to revenue soon after the fiscal year ended. Had this shipment been booked in late 2H19 as opposed to early in 1H20, a2 Milk would have comfortably met the earnings expectations in the market.

The result highlights were:

- Market share in China infant formula rose to 6.4% on an annual basis

- Revenue was up 47% for the year and profits up 41%

- a2 has over $460mn cash in the bank

- Making adjustments for losses in the US/UK, other one-offs and inventory, the result exceeded expectations

The outlook statement for 2020

The outlook statement focussed on stepping up marketing, brand, and product expenses and highlighted further investment in people. This resulted in guidance of a lower percentage earnings margin for the next year.

Lower guidance for 2020 margins could mean that margins will be structurally lower from this point onwards, or higher spending now could mean that a2 Milk is borrowing some of the short-term margins to invest for bigger and more sustainable growth in the future. We think the latter is the dominant force and believe a2 Milk is lifting market expenditure now because they are experiencing revenue and market share growth ahead of their, and the market’s, expectations.

Structural change in margins?

Taking the result announcement at face value, we understand that some investors may extrapolate a permanent reduction in profit margins for a2. This view does have some merit. For instance, as the Company diversifies its product mix and achieves success in the U.S. fresh milk market, the margins for the group will naturally drift lower as liquid fresh milk is a more competitive (lower margin) market than that of a nutraceutical product like infant milk formula.

Similarly, as a2 Milk’s physical store sales (Mother and Baby stores) in China grow as a portion of total sales, it will require additional capabilities including people, analytics, data and technology along with infrastructure and marketing support. These have typically been less essential in a2’s traditional sales channels, such as Australian Daigou. Revenue in this new infant formula channel will be relatively more expensive than revenue in historical channels.

However, we believe that these new channels will exceed the market’s growth expectations and the additional costs will ultimately result in further upside to revenue, albeit at a lag. As an example, a2 stated that their product is now distributed in over 16,000 Mother and Baby stores, up from only 10,000 a year ago. To support this growth, we expect a necessary lift in marketing support expenditure. It is our expectation that there will be up to 18 months lag between increased expenditure and the full associated lift in sales. This future revenue growth appears a sound thesis and we discuss a couple of the growth avenues at the end of this note.

Growth companies should consistently invest in higher sales and earnings for the future

a2 produced revenues of $1.3bn in 2019. They are New Zealand’s second-largest company by market capitalisation (at $12.5bn), but they only have 228 permanent staff today (from 180 a year ago).

For a company expected to grow its revenue by almost $400m in the next 12 months into the two largest consumer markets in the world, a2 has been under-investing for its growth aspirations.

The internal capabilities, be it people or critical infrastructures such as data analytics tools, consumer data, channel expertise or supply chain technology, are not yet where they need to be to capitalise on the large opportunity for a2 to become a global leader in nutritional dairy products.

The Company views the present time as an inflection point, where they need to increase spending significantly to support the growth they are seeking for the next 5 to 10 years. In the absence of this critical investment, a2 Milk may eventually lose competitive momentum.

We sympathise with this view and believe that a2 has begun a 3-year investment cycle in marketing and internal capabilities. For the next 18 months, the Company will be playing catch-up on investment in market capabilities and in the following 18 months, they will continue to invest to support their long-term growth objectives.

This ought to be in the best interests of shareholders and is what great growth companies do – they invest heavily in infrastructure to support future growth. Whilst the accounting lines for investment are different, to say, Fisher & Paykel Healthcare and Xero, we view that the SG&A spending at a2 Milk as just as critical – it is to drive long-term sustainable growth in their large addressable markets.

Market interaction – mea culpa for the Company or the market?

The a2 share price is now back to where it was 2 months ago. The recent strength in the share price was largely driven by earnings upgrades from several analysts. Most channel checks suggested a2 sales have positive momentum and estimates for gross margins were also higher than existing expectations.

There is a wide range of views on a2 sales and earnings prospects as analysts are increasingly undertaking detailed primary research rather than relying on management guidance. In our opinion, the Company still has a large role to play in engaging with analysts to point toward growth opportunities and key business trends. We think that better dialogue will benefit both the Company and the market’s understanding of trading conditions and strategic direction.

We expect further changes at a2 as the Company has employed a professional head of investor relations and is hosting its inaugural investor day in Shanghai in September. We are encouraging a2 to move away from guidance on margins, and instead think about providing guidance on revenue and underlying earnings trends, while maintaining a good information flow on the key success metrics of market share growth.

Where is the long-term growth going to come from?

In our opinion, lower-tier and rural China present a significant growth runway for a2 Milk. Whilst this market may have a higher cost to serve than online sales, the revenue growth opportunity is larger than what is currently appreciated.

a2’s initial success in China was largely concentrated in higher-tier cities. Ironically, this is a market that has had declining birth rates for years, yet the market size has grown and a2 has taken broad-based market share from competitors.

The infant formula market in high-tier cities is smaller than that of lower-tier cities in China and a2 has already made a significant entry into these cities as well. We estimate that in 2019 roughly half of a2’s products are sold to consumers in lower-tier Chinese cities.

We also believe the consumption patterns in high-tier, low-tier and rural China are quite different and present a longer runway for a2’s sales and earnings growth than what is appreciated in the market.

For instance, a2 sells three core infant milk formula products: Stages 1, 2 & 3, together with follow-on formula (Stage 4) and the more recent launch of their Smart Nutrition product aimed at the follow-on year 4-12 market. On our estimates, high-tier China is roughly evenly split between Stage 1 and Stage 2 products at 20-25% each and Stage 3 is currently 50% of sales. However, in lower-tier China, we estimate far less developed Stage 1 and Stage 2 sales, with Stage 3 being some 80% of sales. This is a function of several things, such as mothers going back to work much sooner in high-tier cities and thus supplementing breastfeeding with formula more frequently.

It is our expectation that this consumption pattern will be mimicked by lower-tier parents over time. On our numbers, this is already happening with faster growth rates recently in the earlier Stage products than that of Stage 3.

In rural China, the biggest market for infant milk formula, we estimate an immaterial current presence by a2 currently. This will change in the medium term and, based on our channel checks, we think consumers in this market are already wanting to access a2 product.

We also think the infant milk formula market in rural China is significantly larger than that typically cited by conventional consumer research houses. The recently published draft prospectus by Feihe – China’s largest infant milk formula company and a dominant player in rural areas – values the market in rural (we imply) China as being more than twice the size of previous estimates.

Hence, we fully support the strategic decision by a2 Milk to invest as much as they can into the organisational capability to maximise the chances of long-term sustainable growth both in infant milk formula in China, but also in dairy nutritional products in the U.S.

Our view remains that a2 provides a totally unique consumer proposition and there is now both a very strong balance sheet and cash flow to support growth, stay relevant and play in the big league.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.

[1] Macquarie Research breaks down the margin profile in its 21 August 2019 report: The a2 Milk Company (A2M AU) – More to grow, more growth, or both?