- Country level emissions reduction targets expected to take centre stage to ensure a 1.5 degrees scenario is within reach.

- Carbon trading and ‘leakage’ likely to feature given the adjustment mechanism proposed by the EU.

- Financing the transition will be an important focus, particularly for developing countries that require support.

Over the next few weeks, global leaders will once again join to discuss climate change in the 26th international meeting known as COP26 (Conference of the Parties), this time held in Glasgow. The meeting was originally intended to take place last year and was delayed due to the COVID-19 pandemic. This one will be particularly important as countries assess their progress, or perhaps lack thereof, towards their commitments in the Paris Agreement and consider increasing their ambition for 2030 emissions reduction targets, given the latest climate science.

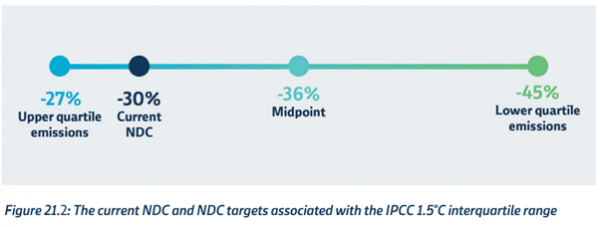

For New Zealand, as part of the Climate Change Commission’s (CCC) advice to Government, they were also tasked to review the Nationally Determined Contribution (NDC) and whether it was consistent with global efforts to limit global warming to 1.5 degrees Celsius. The current NDC for New Zealand is to reduce net emissions to 30% below 2005 emissions levels over the 2021-2030 period. The Climate Change Commission concluded that this NDC was not compatible with the 1.5 degrees goal and would need to be more ambitious with at least a 36% emissions reduction required by 2030.[1] We will be watching closely to see whether Aotearoa New Zealand decides to adopt a new NDC consistent with this evidence provided by the CCC.

Another interesting topic that will likely feature in the discussions will be carbon leakage and international trade interventions based on carbon pricing. Carbon leakage happens when domestically produced goods subject to a carbon price are displaced by imported goods where their emissions have not been properly priced. The EU are currently considering implementing a new policy known as the ‘Carbon Border Adjustment Mechanism’ (CBAM) to address this concern. This CBAM has been proposed to adjust the price of some imported products like cement, steel, and electricity based on the carbon emissions incurred if that country does not have an equivalent carbon price to the EU. This initiative may lead to greater coordination by countries in moving towards a more standardised and consistent international carbon pricing framework, or further adoption of carbon tariff-like policies to address carbon leakage.

Climate finance will also be a key focus, particularly for helping developing countries decarbonise. Many countries have announced significant green infrastructure plans following the economic disruption from COVID-19, but incentives will also need to be changed to redirect capital away from the fossil fuel industry and towards renewables. Developed countries will consider how much aid to provide to less-developed countries, with pressure to make good on a US$100 billion per annum pledge promised back in 2009.[2] New Zealand recently announced a four-fold increase in our support, totaling $1.3 billion, with half of this to Pacific Island nations in the next four years.[3]

Although New Zealand may only be a small contributor to emissions on the global stage, we have set a strong example in some respects, like establishing legislation on a zero-carbon target and climate reporting, an independent Climate Change Commission and a functioning Emissions Trading Scheme that provides a price for carbon.

However, despite having these policy settings in place, there is still significant work required to reduce our emissions to meet our NDC and net zero goals given our high emissions per capita and track record over the past 30 years.[4] Corporates will have an important role to play in this decarbonisation journey, with the biggest impact likely to come from the transport, agriculture and industrial sectors. We will continue to monitor and engage on progress.

[1] Ināia tonu nei: a low emissions future for Aotearoa » Climate Change Commission (climatecommission.govt.nz)

[2] 13.a.1_Background.pdf

[3] New Zealand increases climate aid contribution | Beehive.govt.nz

[4] New Zealand's Greenhouse Gas Inventory 1990-2019 | Ministry for the Environment

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.