- The RBNZ left the OCR unchanged yesterday given heightened health-related uncertainty.

- But with the central bank’s inflation and employment objectives met, the Monetary Policy Committee has a strong desire to reduce stimulus once this uncertainty passes.

- We agree that interest rates eventually need to be a lot higher, but health outcomes will determine when the tightening cycle begins. In fixed income portfolios we are positioned for the OCR to remain on hold while the COVID-19 delta variant outbreak unfolds, but for longer term yields to rise and inflation pressures to persist.

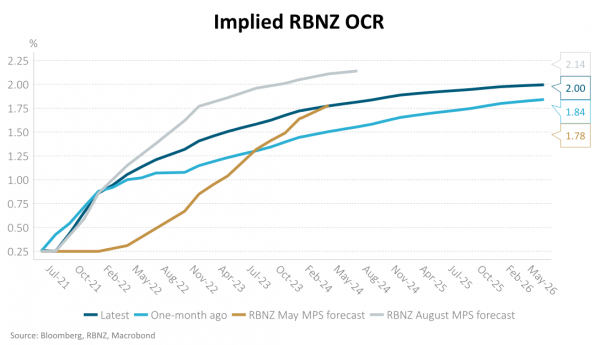

The Reserve Bank of New Zealand (RBNZ) left the Official Cash Rate (OCR) unchanged yesterday at 0.25% in light of the heightened health uncertainty. The Monetary Policy Committee, however, also noted confidence that rising capacity pressures will feed through into inflation, and that employment is at its maximum sustainable level. This confidence was reflected in an OCR forecast that showed hikes beginning earlier and reaching a higher point than the May projections. The OCR is now forecast to rise from Q4 this year and reach 2% by the end of 2023 (see below).

We agree that interest rates eventually need to be a lot higher, but health outcomes will likely determine when the tightening cycle begins. We see two scenarios that frame a spectrum of possible outcomes:

- COVID cases are quickly identified, allowing community transmission to be eliminated and the economy to reopen before the 6 October Monetary Policy Review (MPR). The RBNZ is likely to feel comfortable starting the tightening cycle at this meeting. Financial markets currently assign a 60% chance of a 0.25% hike at the October MPR.

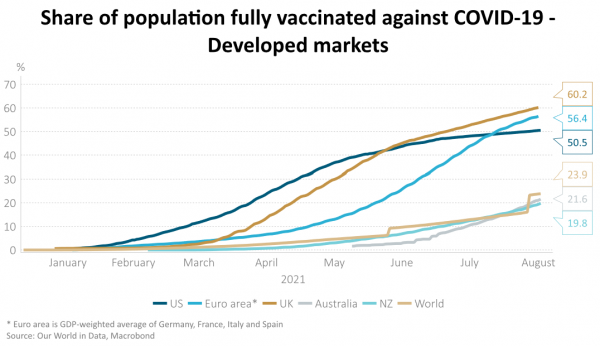

- COVID cases grow and necessitate an extended lockdown due to ongoing community transmission. In this case, the 24 November MPS is likely to be the earliest point at which the tightening cycle can begin. The delta variant is twice as contagious as the original COVID-19 variant and is particularly problematic in populations with low vaccination rates such as ours. Less than 20% of New Zealanders are fully vaccinated and only 30% have had one shot (see chart below). We think the recent situation in the Australian state of Victoria provides an example of the difficulties in containing the delta variant within a strict lockdown. Under this scenario the RBNZ could still justify rate hikes by pointing out that fiscal support is the best policy response to COVID. The timeframe that monetary policy references is longer, capturing an expectation that we see a quick recovery once lockdowns are eased.

We think there is a high probability of lockdown extension and have positioned fixed income portfolios accordingly. Overall duration is slightly longer than benchmarks but concentrated in very short maturities (less than 1-year). We continue to be short duration in longer-dated maturities (more than 7 years) to reflect our view that global rates are likely to rise materially as the global economic expansion continues and the US Federal Reserve reduces QE asset purchases (for further discussion of our global outlook, see our latest Harbour Outlook).

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.