Key Points

- Electric vehicle (EV) adoption, among larger NZX-listed corporates, was assessed through a quantitative and behavioural survey

- There is low EV penetration in company fleets, on average, with significant dispersion between industry sectors

- Reputation benefits are ranked as the most important driver of EV transition

- A lack of suitable EV models is rated as the largest barrier to adoption, even above cost

- A majority of the companies surveyed had immediate plans to invest in more EVs, however this has likely changed in light of COVID-19

An efficient transportation system is essential for any country, but can come at a high cost in terms of infrastructure, as well as environmental and social externalities resulting from greenhouse gas (GHG) emissions, noise and air pollution. Transport emissions are a major source of GHGs, accounting for 20% of total emissions in New Zealand, which is similar to global emissions at 23% (Ministry of Transport (MoT), 2019).

In order to achieve our emissions goals, set under the Zero Carbon Act in New Zealand, emissions in the transport sector must be addressed. The transport sector currently represents the fastest growing emissions source in New Zealand, with an 82% rise from 1990 to 2017, compared to the average rise of 23% in other sectors (MoT, 2019). This has been recognised by the New Zealand Productivity Commission and the Interim Climate Change Committee, who have recommended several initiatives to reduce transport emissions, including a fund to encourage innovation and support charging infrastructure.

To investigate EV adoption in New Zealand, and how it can be used by businesses as a mechanism for climate change mitigation efforts, we conducted a study on a sample of New Zealand’s largest listed companies by market capitalisation. This project was undertaken by a fixed term intern for Harbour, Selina Chan, as part of her Master’s degree in Climate Change Science and Policy. It involved constructing quantitative and behavioural survey questions and engaging with these companies to gain their feedback. To provide context, we also conducted a literature review of the EV market in New Zealand with reference to overseas examples.

Initial investment remains a major barrier to entering the EV market, with prices ranging between $50,000 and $70,000 for a new standard vehicle, and well over $100,000 for larger cars with more range. However, one of the key benefits of EVs is the long-term cost saving in fuel and maintenance over its lifetime. It is estimated that a high emitting car can cost up to $3,000 more per year, in operational and maintenance costs, compared to an EV of a similar model. New and used vehicles in New Zealand also have longer life expectancies compared to North America and Europe.

New Zealand is particularly well suited for a transition to EVs because of the following factors

- Over 80% of the country’s electricity comes from renewable sources, due to advantageous geological location and weather patterns

- New Zealanders pay 65% more in fuel costs compared to the average person in Europe, and double the average in the US (MoT, 2019)

- New Zealanders have a shorter average commute to work, so the typical driving distance is easily within the range of EVs, without charging

- More than 85% of homes have convenient off-street parking, making charging practical (MoT, 2019)

- On-road air pollutants and vehicle noise have been shown to cause premature mortality, and additional hospital admissions, resulting in an estimated social cost of $942m (Ministry for the Environment (MfE), 2015)

Global context

The International Energy Agency (IEA) recorded a significant increase of 63% year-on-year in global EV fleet markets to 5.1 million in 2018. Given the, approximately, 1.42 billion vehicles in operation worldwide, this represents an average EV market size of 0.36% (proportional to New Zealand at 0.35%). Geographically, China accounted for 45% of EVs on the road in 2018, compared to 24% in Europe and 22% in the US. (IEA, 2019)

The EV supply and market uptake in New Zealand inevitably follows the global market. However, in New Zealand, most EVs are owned by individuals instead of governmental bodies or corporates, unlike in most other OECD countries. Despite a very pro-EV stance claimed by the New Zealand Government, little in the way of financial incentives or tax deductions have been offered to make the transition to EVs a less costly one. According to companies in our survey, until some type of material government intervention is offered, New Zealand will likely continue to lag in EV ownership, both in commercial fleets and individually owned vehicles.

Many of New Zealand’s largest companies voluntarily joined an EV initiative in 2016, committing to transform at least 30% of their corporate fleets to electric vehicles by 2019 (Smellie P, 2016). However, progress in this initiative has proved difficult to track given updated EV statistics are not readily available in the public disclosure of all the companies. We subsequently sought to engage with a sample of the largest companies listed on the New Zealand Exchange (NZX) through a survey designed to investigate their EV fleet statistics, as well as the behavioural drivers and barriers to uptake.

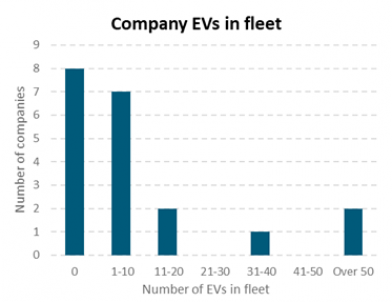

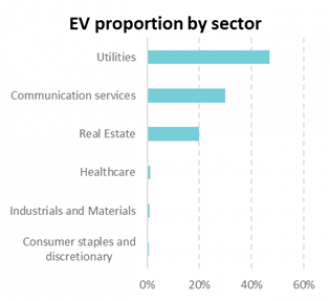

From the 20 companies that responded (out of 24), 75% had 10 or less EVs in their fleet, of which eight had none at all. A couple of outliers had more than 50 EVs in their fleet. These amounts are proportionately low compared to the total vehicle fleets across the companies on average, although sector dispersion was evident. The strongest EV penetration was seen in the utilities and communications sectors, however absolute fleet numbers varied significantly between the sectors. The utility sector has a natural advantage with access to “free” power and an alignment with brand imagery.

The growth in EV adoption has not been linear; it has increased by 350 overall in the past decade for the sample, but this has been driven by peaks in 2009 and 2018 from those sectors identified with the highest EV proportions. This shows that, despite rhetoric from many large New Zealand companies on transitioning their fleets towards EVs, there is no discernible trend evident across sectors, at least from our sample.

Out of the 12 companies with EVs in their fleet, only seven responded to the follow-up behavioural questions, likely due to the timing of the COVID-19 crisis.

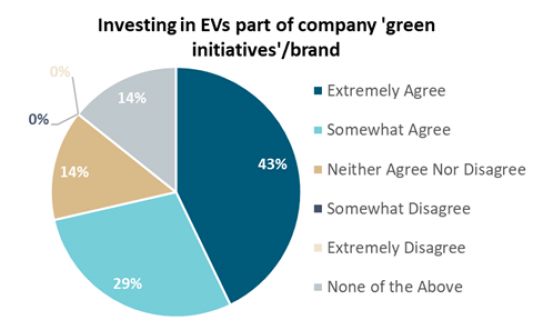

Brand image and organisational reputation received the most support out of the motivating factors for EV investment, with 72% of the surveyed sample agreeing, either somewhat or extremely. Other factors included helping achieve New Zealand’s Zero Carbon targets, increasing environmental, health and wellness benefits to society, and fuel and maintenance cost savings. This is consistent with the global EV100 survey results in 2019, where reputational benefits were identified as one of the top three reasons for 100 large global EV leading companies.

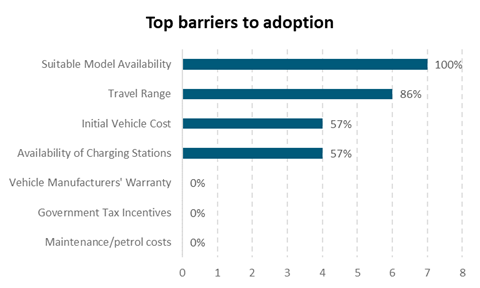

While significant, cost is not the number one roadblock for companies to invest in more EVs. Only around half of the sample state that initial cost is a significant deterrent in adopting more EVs. The majority say that they believe that savings from the lower operational costs would help but it is not the deciding factor for switching. Instead, the lack of available, suitable EV vehicle models in the New Zealand market is the leading deterrent. Companies argue that a minimum travel range of 200km without charge is necessary, and that affordable EVs in this range are scarce.

In terms of the outlook on EV adoption, 75% of the sample responded that they had immediate plans to invest in more EVs, although this may change in light of COVID-19 and companies’ balance sheet flexibility. In the longer term, these companies were less confident about EV uptake in New Zealand, compared to the consensus expressed by other EV fleet market leaders in North America and Europe, with half of the sample believing that EVs would not become NZ’s main mode of transport within this decade. Comments from the corporates highlighted the lack of support from the New Zealand Government, indicating they remain skeptical, if not pessimistic, when it comes to a potential commercial EV mass roll-out within this coming decade.

Implications

The COVID-19 pandemic that unfolded during this study has created wide-ranging, devastating impacts and significant uncertainty that will likely influence the EV market’s direction in New Zealand, and around the world.

With governments focusing on the crisis, there are fears that the diplomatic push to refocus global efforts on emissions reduction could slip. The United Nations Climate Change Conference (COP26) has been officially postponed a year until 2021 in Glasgow, Scotland. It has been hailed as the most important climate gathering since the Paris Accord in 2015, and a delay of this magnitude would likely have significant negative impacts on the environment. Countries are due to meet at COP26 to sign new pledges to limit warming to 2 degrees Celsius, with many currently falling woefully short of their goals under the agreement.

Among corporates, this shock has resulted in a strong focus on repairing balance sheets and deferring non-essential capital expenditures. There is a risk that expenditure related to green initiatives are included in this opportunity cost, and general emissions reduction initiatives are de-prioritised in favour of near-term financial considerations to return to the status quo.

Oil prices have plummeted since COVID-19 began, following from failed production agreements between Saudi Arabia and Russia and the dismal demand for oil due to substantially reduced flights and commuting. These reduced prices change the economics of the equation, skewing the operational cost aspect closer to high emissions vehicles.

However, there is a silver lining to the pandemic when it comes to the environment. It has been estimated that daily global carbon emissions decreased by 17% by early April compared with the average 2019 levels (Le Quéré C. et al., 2020). The sharp decrease in both carbon emissions and air pollution, as a result of the virus containment measures, showcase the environmental improvements that can be achieved after only a very short period of drastic intervention. However, the effect is not expected to be long-lasting, according to climate change scientists.

Conclusion

Overall, based on our sample, current EV utilisation by New Zealand companies is generally low, relative to both New Zealand’s emissions reduction goals and other western countries. Commercial EV fleets, unlike in some other nations, are not leading the New Zealand EV transition today. Residential EV owners are the main contributors and will likely continue to be unless there is a step-change in corporate behaviour or increased regulation.

It is important to note that, although the survey includes some of New Zealand’s largest companies, it is still limited by its small sample size and sampling bias meaning that results are not necessarily representative of the overall New Zealand EV market. It is, however, reasonable to assume that when our largest corporates are under-indexing in their use of EVs, the smaller companies not captured in this survey will lag even further behind.

Technological breakthroughs, in both car and battery manufacturing, occur every 5-7 years and often revolutionise the way we view transport. This is the main driver many are counting on to reduce EV costs and prepare the market for the next phase in EV transition. Environmental economists caution that, although green brand image and climate impacts provide incentives for change, sticker-price parity will ultimately create the level playing field that is necessary for a mass EV rollout. We will continue to monitor these trends through an investment lens as part of our thorough research programme, as the New Zealand Government and corporates alike move towards a low emissions future.

Sources

International Energy Agency (2019). Global EV Outlook.

Le Quéré, C., Jackson, R.B., Jones, M.W. et al. (2020). Temporary reduction in daily global CO2 emissions during the COVID-19 forced confinement.

Ministry for Environment (2015). Environment Aotearoa p30

Ministry of Transport (2019). Moving the light vehicles fleet to low emissions: discussion paper on a Clean Car Standard and Clean Car Discount

Smellie, P. (2016). NZ major corporates commit to electric vehicles fleet expansion https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11729103

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.