- Harbour’s internal Macro Research Day is a chance to hear from external research providers, challenge assumptions and anchor our medium-term view.

- Highly effective COVID-19 vaccines and early rollout are allowing investors to look past the current acceleration in northern hemisphere cases.

- The New Zealand tourism industry is likely to miss international visitors over summer, however the rest of the economy is doing exceptionally well. Perhaps too well in the case of housing where Reserve Bank of New Zealand Loan-to-Value Ratio restrictions are coming to curb high-risk lending.

Harbour held its bi-annual internal Macro Research Day recently where, with the help of several external speakers, we examined the global and domestic economic outlooks, the health of our tourism industry, New Zealand financial system risks, and the prospect of meaningful government policy change. The Macro Research Day is an important part of Harbour’s research calendar, providing a chance to test our medium-term view of the market outlook.

The key takeaways were:

The high efficacy of COVID-19 vaccines is game-changing and confirms a return to normalcy in the foreseeable future. The US, for example, is likely to have vaccinated the most vulnerable parts of its population by the middle of 2021, allowing markets to look through the current surge in cases. Ongoing monetary policy stimulus is also helping to support sentiment and high inflation is unlikely to force a sudden increase in interest rates. Wage inflation should remain low until labour markets fully recover and ongoing technological advancement is continuing to limit price increases. The US trucking industry provides a pertinent example of the impact that technology is having on wage growth. With the advent and ongoing improvement of automated driver assistance, the skill level required to drive large trucks has steadily declined in recent decades. As a result, the median US truck driver salary rose just USD4,000 between 1980 and 2013 to USD42,000, without adjusting for inflation.

New Zealand economic risks have become less skewed to the downside, yet challenges remain. The economy is in a much better state than many had anticipated earlier this year, particularly the labour and housing markets. Credit growth outside of housing, however, remains anaemic, capacity constraints are emerging in some sectors and the tourism industry is likely to miss the normal influx of foreign visitors over summer.

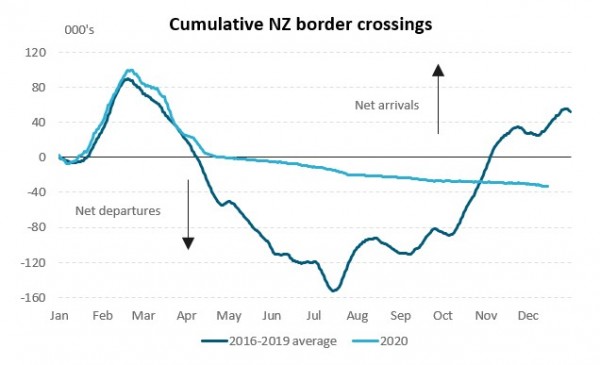

Domestic tourist spending is unlikely to completely replace international visitor spending that would normally happen over summer. Foreign tourist arrivals are greatest between December and March, with February the highest. Activity-based tourism, such as bungy jumping, is particularly vulnerable as it is more popular with foreigners. Tourism New Zealand are attempting to encourage domestic tourists into these areas via its new campaign – “Do something NEW New Zealand”. With border reopening the ultimate solution, the industry faces a slow recovery. Surveys conducted by Tourism New Zealand suggest there is strong public support for restarting international tourism, but only when it is safe to do so. That safety is unlikely to be achieved completely until a vaccine is widely available, most likely at the end of 2021 or beginning of 2022. Along the way, border reopening is likely to take place in a piecemeal way with travel bubbles created with countries that are deemed “safe”, however potential travellers may be deterred by health risks and higher travel costs.

Source: New Zealand Customs Service

The economic shock of COVID-19 has illustrated the resilience of New Zealand’s financial system. New Zealand banks entered 2020 with large capital and liquidity buffers that had been built up since the Global Financial Crisis. Monetary and fiscal policy support have helped to limit the rise in unemployment, the best indicator of financial system stress. Risks remain, however, as government support wanes and debt in some sectors remains high, e.g. dairy and households. Rapid recent house price gains have been fuelled by lower interest rates and houses are extremely expensive on traditional valuation metrics. With house price growth likely to continue to outstrip growth in incomes, the housing market is becoming increasingly vulnerable to a sharp correction should demand and supply conditions rapidly change. To help reduce high-risk lending and shield the financial system from a possible economic downturn or drop in house prices, the Reserve Bank of New Zealand is likely to reimpose Loan-to-Value Ratio restrictions from March 2021.

Surveys suggest most New Zealanders think the country is going in the right direction, likely helped by our COVID-19 response. Political issues that may be a focus over the next 1-2 years are housing, child poverty, climate change and transport. Foreign policy is also likely to be an area of interest as New Zealand manages its delicate relationship with China, Australia, and the US.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.