We’re staying

- Rio Tinto and Meridian have today announced an extension to the Tiwai contract through to December 2024.

- The government has not as yet needed to provide any support

- We would expect further announcements on project development with Contact progressing the Tauhara geothermal plant and Meridian developing their Harapaki wind farm.

Former Wallabies Half-back, George Gregan, will be remembered by New Zealanders from the 2003 World Cup for his infamous ‘Four More Years’ sledging he made to Bryon Kelleher in the dying minutes of the semi-final, which rubbed salt into the wounds as the All Blacks’ drought was extended to 20 years.

The Australians may have done it again with today’s announcement being a masterstroke in terms of negotiating and getting one over their New Zealand cobbers.

If we recall, in July 2020 the announcement to close the smelter was predicated on the view of low profitability of the smelter and a global view of a high carbon intensity of the overall division. Despite the New Zealand plant being one of the cleanest facilities and having a higher purity product, the negotiating screws were tightened. The view at the time was that Rio was looking for $100m of cost savings either from the electricity contracts or from transmission costs.

Today’s announcement sees the extension of the contract for Tiwai through to December 2024. We do not have any detail as yet on the pricing but, given the $100m of savings that Rio was after, it implies a $20mwh price reduction from the current contract pricing of around $55mwh.

Whilst Meridian is the contracting party to the smelter, Contact Energy, which would have been a loser from the closure, has also provided a 100mw commitment, helping to share the load.

The revised pricing and the lift in aluminium prices, from the lows at the time of the closure announcement, will provide a further lift to smelter profitability and shift the operation back into the middle of the global cost curve.

Source: Bloomberg

This intervening period up to December 2024 will still allow the planned upgrades to transmission in the Clutha Upper Waitaki lines project, and further development work on the HVDC link and potentially North Island battery storage. It will also allow, in a sensible manner, the opportunity to accelerate de-carbonisation in New Zealand.

For instance, plans to consider replacement cycles in coal-fired milk powder drying plants, particularly in the South Island, could be accelerated, and green hydrogen and data centres could also be assessed as future replacement demand sources once the smelter does eventually close.

The electricity companies will also now be dusting off the development projects, with Contact Energy’s Geothermal Tauhara project likely to get the green light, and Meridian’s North Island Harapaki wind project also likely to go ahead. Today’s announcement will also provide the companies an element of certainty over cash and dividends which we would expect further confirmation of in the February reporting round.

Equity market impact

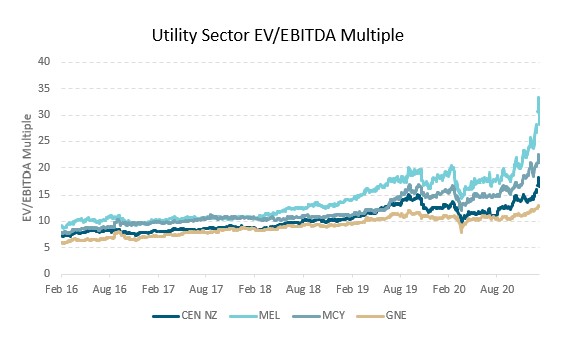

The price movements of the sector and, in particular, Meridian and Contact Energy in the last six months has been principally driven by Clean Energy ETF fund flows rather than any change in the profitability of the companies. As such, the valuations in some sense already capture a lot of this good news.

Source: Harbour, Bloomberg

Maybe in four more years the industry will be in a stronger position with better transmission, a route to decarbonisation, and alternative demand sources that we can get one back on the Aussies and say, ‘yeah, nah, not this time mate’.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.